Accounts receivable outsourcing is the practice of delegating invoice management, payment tracking, and collections processes to a specialized third-party service provider. These services form a critical part of finance and accounting outsourcing and help businesses maintain consistent cash flow while reducing administrative burden.

Accounts receivable outsourcing services typically cover invoice generation, customer billing, payment follow-ups, dispute resolution, and accounts receivable reporting. By outsourcing AR processes, organizations gain access to structured workflows, skilled accounting professionals, and technology-driven processes that improve accuracy and visibility across receivables.

Effective accounts receivable management directly impacts a company’s liquidity and financial stability. Delayed payments, invoicing errors, and inefficient collection processes can lead to cash flow gaps and increased days sales outstanding (DSO). These challenges often intensify as businesses scale or expand into new markets.

Managing accounts receivable in-house requires dedicated teams, robust systems, and consistent monitoring. Many businesses struggle to balance this workload alongside strategic finance priorities. Outsourcing accounts receivable operations allows organizations to maintain control over receivables while benefiting from standardized processes and improved payment cycles.

Common challenges in in-house accounts receivable include manual invoicing, inconsistent follow-ups, limited reporting visibility, and compliance risks. Additionally, staffing constraints and skill gaps can affect the quality of AR operations.

Accounts receivable outsourcing solutions address these issues by introducing best practices, automation, and data-driven insights. As part of broader accounting outsourcing services, AR outsourcing helps businesses create more predictable cash flows and stronger financial discipline.

One of the primary goals of accounts receivable outsourcing is to accelerate cash inflows and reduce outstanding balances. By outsourcing AR processes to experienced service providers, businesses benefit from systematic invoicing, timely payment reminders, and structured collection workflows. These measures help reduce delays and improve payment cycles, resulting in healthier cash flow.

Accounts receivable outsourcing services also focus on reducing days sales outstanding (DSO). Dedicated AR teams monitor receivables continuously, identify overdue accounts early, and follow up proactively. This level of consistency is often difficult to maintain with in-house teams managing multiple priorities.

Invoicing errors and unresolved disputes are common reasons for delayed payments. Outsourced accounts receivable management introduces standardized billing processes and validation checks to minimize inaccuracies. Service providers use defined approval workflows and documentation controls to ensure invoices are accurate and compliant with customer agreements.

When disputes arise, AR outsourcing teams manage them efficiently by coordinating between sales, operations, and customers. This structured approach helps resolve issues faster and prevents them from escalating into long-term payment delays.

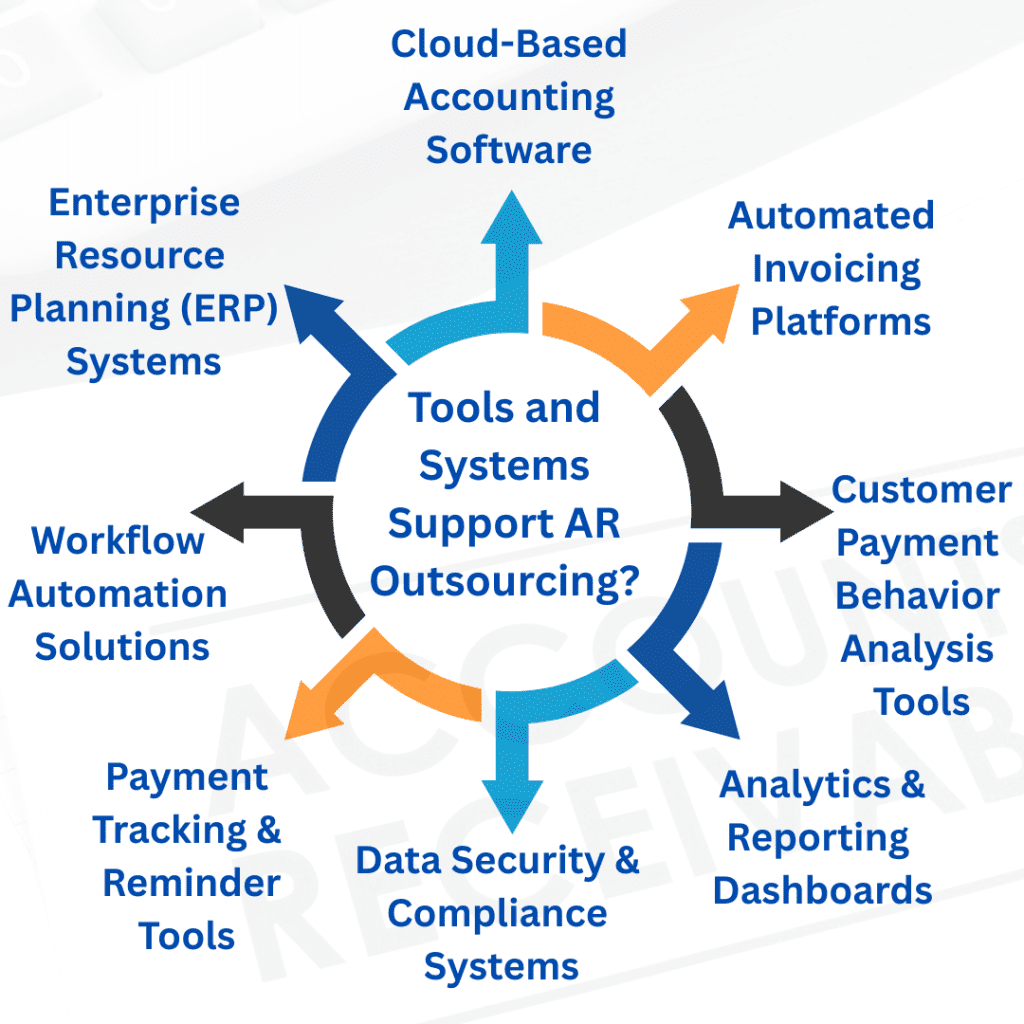

Technology is a critical component of modern accounts receivable outsourcing solutions. Service providers leverage automation tools, cloud-based accounting platforms, and AR dashboards to track invoice status, payment trends, and customer behavior.

These tools enhance transparency and provide real-time insights into receivables performance. With detailed reporting and analytics, businesses can make informed decisions about credit policies, collection strategies, and customer risk management. As part of broader finance and accounting outsourcing, AR outsourcing transforms receivables from a reactive process into a strategic financial function.

Accounts receivable outsourcing services cover a wide range of activities designed to streamline billing and collections. Core services typically include invoice creation, customer billing, payment application, aging analysis, and follow-up on overdue accounts. Many providers also handle credit checks, dispute management, and AR reconciliation to ensure accuracy across financial records.

As part of end-to-end accounting outsourcing services, AR outsourcing often integrates seamlessly with accounts payable and general ledger functions. This integrated approach improves data consistency and enhances overall financial reporting.

Accounts receivable outsourcing has become a strategic solution for businesses seeking improved cash flow, better financial control, and operational efficiency. By outsourcing AR processes, organizations can streamline invoicing, reduce payment delays, and improve visibility into receivables performance. This structured approach helps minimize errors, resolve disputes faster, and maintain stronger customer relationships.

Modern accounts receivable outsourcing services combine skilled professionals, standardized processes, and advanced technology to support scalable growth. Whether for small businesses or large enterprises, outsourcing accounts receivable operations allows finance teams to focus on strategic planning rather than routine follow-ups. As part of broader finance and accounting outsourcing, AR outsourcing transforms receivables into a predictable and manageable financial function.

Accounts receivable outsourcing involves delegating invoicing, payment tracking, and collections to a specialized third-party service provider to improve efficiency and cash flow.

By ensuring timely invoicing, consistent follow-ups, and faster dispute resolution, AR outsourcing helps reduce days sales outstanding (DSO) and accelerates payments.

Yes, AR outsourcing is scalable and beneficial for small and mid-sized businesses that want professional receivable management without expanding internal teams.

Common services include invoice generation, payment application, aging analysis, customer follow-ups, dispute management, and receivables reporting.

Reputable AR outsourcing providers use secure systems, data protection protocols, and compliance frameworks to safeguard sensitive financial information.

Subscribe to our newsletter and stay updated.