Income Tax in India: A Complete Guide to Filing, Deductions, and Refunds

Income tax is a mandatory financial contribution paid by individuals and businesses to the government based on their earnings. In India, income tax plays a vital role in funding public services such as infrastructure, healthcare, education, and national development programs. Whether you are a salaried employee, self-employed professional, business owner, or NRI, understanding what is income tax is essential for managing your finances responsibly.

With the increasing availability of HR technology and online platforms, file income tax online has become easier than ever. However, many taxpayers still find the income tax return process confusing due to changing rules, slabs, and documentation requirements. This guide simplifies income tax concepts in a practical and easy-to-understand way.

What Is Income Tax in India?

Income tax is a type of direct tax levied by the Government of India on the income earned by individuals and entities during a financial year. The Income Tax Department collects this tax under the Income Tax Act, 1961.

Income earned from various sources such as salary, business profits, capital gains, and other sources is considered taxable income, after adjusting eligible tax deductions, exemptions, and rebates.

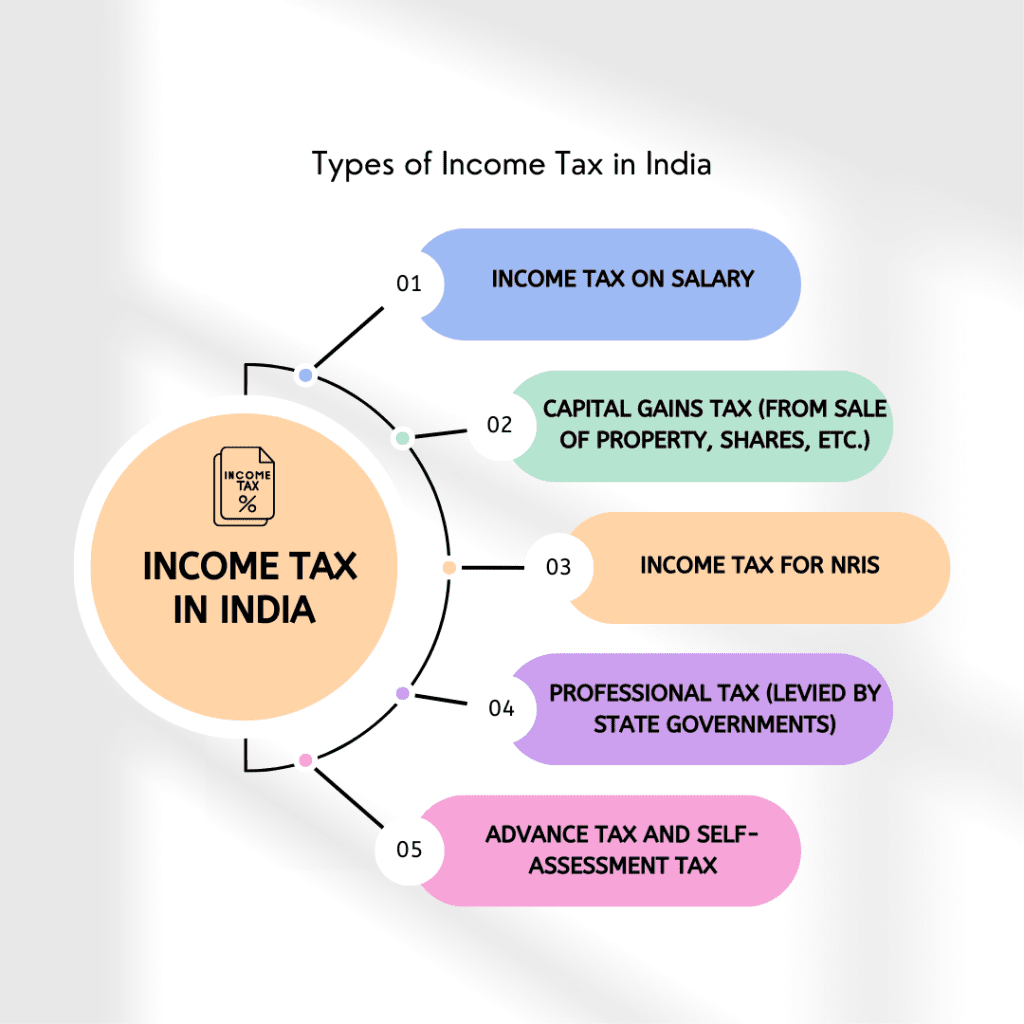

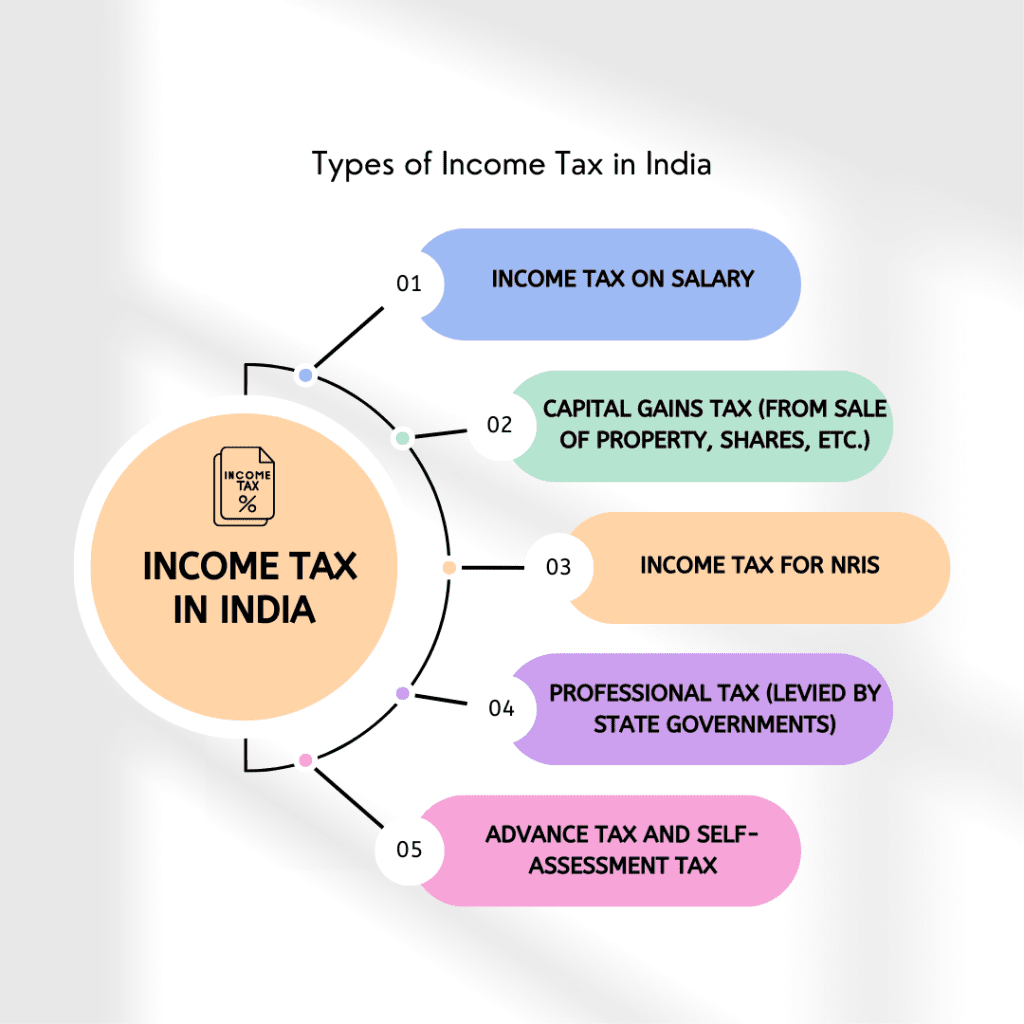

Types of Income Tax in India

Understanding the types of income tax helps taxpayers identify how their earnings are taxed. The major categories include:

Each type follows specific rules and tax rates under Indian income tax laws.

How Is Income Tax Calculated?

Many taxpayers ask: How income tax is calculated?

The calculation follows a structured process:

- Calculate total income from all sources

- Subtract exempted income under Section 10 exemptions

- Apply eligible deductions like Section 80C, Section 80D, Standard deduction, and Section 24(b)

- Arrive at net taxable income

- Apply applicable income tax slab and income tax rates

- Adjust tax rebate, advance tax paid, and TDS

The final amount payable is your tax liability.

What Are Income Tax Slabs and Rates?

The Indian income tax system operates on a slab-based taxation structure, where tax rates vary according to an individual’s income level, age group, and selected tax regime. Different slabs ensure fair taxation by applying higher rates to higher incomes. Senior citizens are offered special income tax slabs, providing them with added tax relief and flexibility in financial planning. Choosing the right tax regime plays an important role in determining overall tax liability. Being aware of the latest income tax slab rates for 2025–26 helps taxpayers make informed decisions. It also enables better tax planning and reduces the risk of penalties or underpayment.

How to File Income Tax Online Step by Step

Filing an income tax return is a legal responsibility for individuals earning taxable income in India. With the introduction of digital platforms, the option to file income tax online has made the process faster, safer, and more transparent. Online filing reduces paperwork, minimizes errors, and allows taxpayers to track their return and refund status easily. Despite these advantages, many people still find the income tax return process confusing due to multiple forms, changing rules, and documentation requirements.

Below is a detailed, step-by-step guide to help you file your income tax return online with confidence:

What Is an Income Tax Return (ITR)?

An income tax return is a form submitted to the Income Tax Department that reports your income, deductions, taxes paid, and tax liability for a financial year. Filing an ITR allows taxpayers to:

- Claim income tax refund

- Carry forward losses

- Maintain compliance with income tax rules in India

The government provides different ITR forms based on income type and taxpayer category.

Who Should File Income Tax Returns?

You must file tax return if:

- Your total income exceeds the basic exemption limit

- You want to claim a tax refund

- You have foreign income or assets

- You are an NRI earning income in India

- You paid advance tax or self-assessment tax

Even eligible individuals can opt for free income tax filing through government portals.

What Documents Are Required for Income Tax Filing?

Before starting the return filing, keep the following documents ready:

- PAN and Aadhaar linking confirmation

- Form 16 (for salaried employees)

- Form 26AS (tax credit statement)

- Bank statements and interest certificates

- Investment proofs for Section 80C and Section 80D

- Capital gains statements, if applicable

These documents help ensure accurate reporting and avoid errors.

How to File Income Tax Online in 2025

Here is a step-by-step income tax return filing guide:

- Log in to the official income tax e-filing portal

- Select the appropriate ITR form

- Enter income details and deductions

- Calculate tax using a tax return calculator

- Pay tax (if applicable) using a tax payment challan

- Submit the return and complete e-Verification of ITR

E-verification is mandatory to complete the filing process.

What Happens After Filing Your Income Tax Return?

Once filed and verified:

- The Income Tax Department processes your return

- Any excess tax paid is issued as an income tax refund

- You can check your income tax refund status online

Timely filing helps avoid late fees and ensures smooth refund processing.

How Can You Save Tax Legally in India?

Smart tax planning helps reduce your tax liability while staying compliant with income tax rules in India. By understanding available income tax deductions and exemptions, taxpayers can significantly lower their taxable income and improve savings.

Let’s explore the most important provisions.

What Are Income Tax Deductions and Exemptions?

Tax deductions reduce your taxable income, while exemptions exclude certain income from taxation. Both are essential tools for effective income tax planning.

Common deductions and exemptions are available under the Income Tax Act through various sections.

What Are the Key Income Tax Deductions Under Section 80C?

Section 80C is one of the most popular provisions for tax savings. It allows deductions up to ₹1.5 lakh on eligible investments and expenses, including:

- Provident Fund (PF)

- Public Provident Fund (PPF)

- Life insurance premiums

- ELSS mutual funds

- Tuition fees for children

Using Section 80C wisely can significantly reduce taxable income.

How Does Section 80D Help Save Tax on Health Insurance?

Section 80D provides deductions for health insurance premiums paid for:

- Self and family

- Parents (additional benefit)

This deduction encourages health security while offering tax savings.

What Is Standard Deduction for Salaried Employees?

Salaried individuals can claim a standard deduction, which reduces taxable salary income without submitting investment proofs. This benefit simplifies tax filing and reduces paperwork.

What Are HRA Exemption Rules and Section 24(b)?

- HRA exemption rules allow salaried employees living in rented accommodation to claim house rent allowance exemptions.

- Section 24(b) allows deductions on interest paid on home loans, benefiting homeowners.

These provisions help reduce tax burden on housing-related expenses.

What Are Section 10 Exemptions and Exempted Income?

Certain incomes are fully or partially exempt under Section 10 exemptions, such as:

- Leave Travel Allowance (LTA)

- Gratuity (subject to limits)

- Certain allowances

Understanding exempted income ensures correct tax calculation.

Income Tax Saving Tips for Salaried Employees

- Plan investments early in the financial year

- Use tax calculators to estimate liabilities

- Maintain proper documentation

- Avoid last-minute filings

Effective tax planning ensures compliance and maximizes savings.

How to Stay Compliant and Stress-Free

Even experienced taxpayers can make errors while filing income tax returns. Understanding common pitfalls, refund processes, and compliance rules helps avoid penalties and ensures smooth processing of your income tax return.

What Are Common Mistakes in Income Tax Returns?

Some frequent errors taxpayers make include:

- Incorrect personal details or bank information

- Selecting the wrong ITR forms

- Missing income from interest or capital gains

- Claiming incorrect deductions under Section 80C or Section 80D

- Not completing e-Verification of ITR

These mistakes can delay refunds or lead to notices from the tax department.

How to Avoid Penalties in Income Tax Filing?

To avoid penalties and interest:

- File returns before the due date

- Pay advance tax and self-assessment tax on time

- Cross-check Form 16 and Form 26AS

- Use a reliable tax return calculator to estimate tax liability

Timely compliance helps avoid late filing fees and interest charges.

How to Check Your Income Tax Refund Status?

If excess tax has been paid, you are eligible for an income tax refund. After filing:

- Visit the income tax e-filing portal

- Log in using PAN credentials

- Track refund status under “My Account”

Refunds are usually credited directly to your bank account.

Why Free Income Tax Filing Is Gaining Popularity

Government portals now offer free income tax filing, making it easier for individuals to file returns without professional assistance. These platforms guide users step by step and support online tax payments through a tax payment challan.

Frequently Asked Questions (FAQs)

What is income tax?

Income tax is a direct tax charged by the Government of India on income earned by individuals, professionals, and businesses. It is governed by the Income Tax Act, 1961 and helps fund public services and development.

Who needs to file income tax returns?

Any individual or entity whose income exceeds the basic exemption limit must file an income tax return. Filing is also required if you want to claim a tax refund or carry forward losses.

What documents are required for income tax filing?

Key documents include PAN, Aadhaar, Form 16, Form 26AS, bank statements, and investment proofs. These help ensure accurate income reporting and deduction claims.

How income tax is calculated?

Income tax is calculated by adding income from all sources and subtracting eligible deductions and exemptions. The remaining taxable income is then taxed according to applicable income tax slabs.

Can I file income tax online for free?

Yes, the Income Tax Department provides free online filing through its official e-filing portal. This platform allows easy return submission and e-verification.

What is the latest income tax slab for senior citizens?

Senior citizens are eligible for higher basic exemption limits compared to regular taxpayers. This provides additional tax relief under current income tax laws.

Final Takeaway

Understanding income tax is key to financial discipline. With the right planning, accurate filing, and awareness of rules, taxpayers can reduce liabilities, avoid penalties, and stay compliant with ease.