In today’s complex business landscape, corporate governance is no longer just a board-level responsibility; it’s a foundational framework that determines how responsibly, transparently, and ethically an organization operates. As global regulations tighten, investor scrutiny increases, and markets demand more accountability, businesses are shifting toward comprehensive corporate governance solutions that integrate compliance, risk management, internal controls, and ESG reporting into a single strategic system.

From multinational corporations to rapidly scaling startups, leaders are asking critical questions:

Effective governance is no longer optional it is the backbone of sustainable growth, ethical conduct, and long-term business continuity.

Corporate governance refers to the systems, rules, and processes that define how a company is directed and controlled. It shapes the relationship between stakeholders, board members, executives, investors, employees, and regulators and establishes a culture of transparency, accountability, and ethical standards.

Modern governance goes beyond checking regulatory boxes. It ensures that strategic decisions are made responsibly, risks are mitigated proactively, and business practices align with both global norms and societal expectations.

Strong governance practices bring several transformational benefits:

When organizations demonstrate transparency, consistent reporting, ethical conduct, and strong internal controls, they build trust with investors, employees, customers, and regulatory bodies.

Governance assigns clearly defined roles, responsibilities, and leadership structures, ensuring everyone from the board to the last mile is accountable for decisions and performance.

With global regulations evolving constantly, governance frameworks provide structure for:

A governance framework strengthens how the board of directors functions:

Governance integrates ESG reporting, ethical standards, regulatory compliance, and cultural values. This future-proofs the organization and enhances corporate reputation.

Weak or outdated governance leads to direct and sometimes irreversible consequences. These risks often escalate silently until they become major failures.

Without a strong risk management structure:

Poor internal controls enable:

Without proper governance, even small mistakes turn into massive liabilities.

Without structured governance, organizations struggle to keep up with:

This leads to fines, audits, legal action, and reputational damage.

When roles and responsibilities are unclear, decision-making becomes fragmented. Miscommunication between leadership teams weakens strategy execution and restricts growth.

Governance helps define and strengthen ethical standards, responsible practices, and transparent communication. Without it, organizational culture deteriorates, creating silos, distrust, and poor employee engagement.

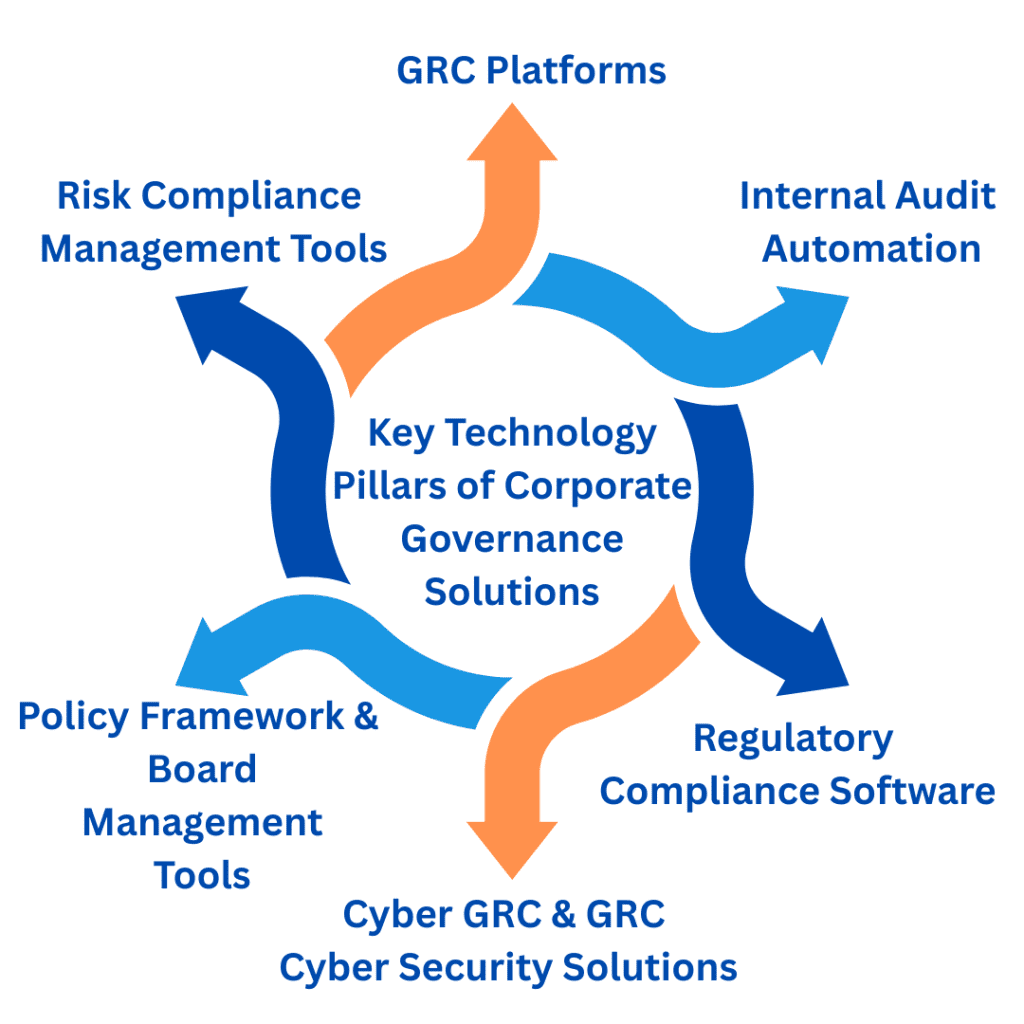

Corporate governance solutions are technology-enabled systems, frameworks, and tools that help organizations maintain transparency, manage risks, automate compliance, strengthen internal controls, and improve board-level decision-making.

In the past, governance was manual led by spreadsheets, siloed reports, and outdated documentation. Today, businesses rely on GRC platforms, audit automation tools, and regulatory compliance systems that deliver real-time visibility and proactive risk control.

At their core, governance solutions help organizations achieve four main goals:

These solutions unify enterprise-wide governance activities and reduce operational complexities.

1. GRC Platforms – The Heart of Modern Governance

A GRC platform integrates Governance, Risk, and Compliance into one connected system. It provides visibility across departments, helping leadership teams track enterprise risks, compliance updates, policies, and control mechanisms.

Benefits of a GRC Platform:

Whether you choose Oracle GRC, SAP GRC, or a cloud-based AI-driven platform, the goal remains the same: streamline governance and eliminate fragmented reporting.

2.Risk Compliance Management Tools

Risk compliance tools help organizations identify, assess, and mitigate risks across operational, financial, cybersecurity, and strategic domains.

These tools allow businesses to:

This structured approach eliminates surprises and strengthens proactive decision-making.

3.Internal Audit Automation

Manual audits are slow, costly, and prone to error. Internal audit automation digitizes the entire audit lifecycle:

Automated audits not only improve transparency but also help leadership teams identify gaps in internal controls before they escalate.

4.Cyber GRC & GRC Cyber Security Solutions

Cybersecurity governance is now a board-level priority. With rising cyber threats, organizations need Cyber GRC systems that merge IT security, governance, and risk management.

These tools help monitor:

Cyber GRC enhances both security posture and governance maturity.

5.Regulatory Compliance Software

With global regulations shifting rapidly, businesses need systems that track and manage compliance obligations in real time.

Regulatory compliance software helps organizations:

This minimizes manual effort and prevents costly violations.

6.Policy Framework & Board Management Tools

A strong policy framework acts as the backbone of governance. Policy management tools help organizations:

Board management tools support:

Together, they drive leadership alignment and governance excellence.

Corporate governance is not only about systems and compliance it is about building a foundation of ethical standards and a strong corporate culture. While governance tools offer structure and visibility, it’s the culture that ensures consistent, ethical decision-making at all levels.

1.Ethical Standards as a Governance Anchor

Strong ethical standards define acceptable behavior, create fairness, and reduce risks of misconduct. Organizations with clear ethical values experience:

Ethics form the backbone of accountability and transparency—two pillars essential for good governance.

2.Corporate Culture and Governance Maturity

Governance excellence cannot be achieved with a weak culture. A strong corporate culture improves:

When leadership demonstrates integrity and accountability, employees follow.

In recent years, Environmental, Social, and Governance (ESG) reporting has become a crucial part of global governance standards. Investors, customers, and regulators increasingly evaluate companies based on their ESG commitments.

Why ESG Reporting Matters for Governance:

Key Components of ESG Governance:

Sustainability reporting, combined with governance frameworks, positions the company as responsible, ethical, and future-ready.

Stakeholder Management in Corporate Governance

Governance is designed to protect and empower stakeholders. These include:

Effective stakeholder management ensures that the interests of all parties are considered in decision-making. This helps companies achieve:

Smart companies map their stakeholder expectations and align them with governance goals.

Modern frameworks are built on universally accepted principles of corporate governance. These principles help organizations build strong leadership, ethical transparency, and resilient internal systems.

Core Principles Include:

These principles act as a north star and guide organizations during transformation, crisis management, and strategic execution.

The board of directors plays the most crucial role in setting the tone, direction, and oversight of governance systems.

Key Responsibilities Include:

Boards ensure that the company is not just profitable but ethical, transparent, and sustainable.

A board portal is a secure digital hub where directors access documents, communicate, and collaborate efficiently.

Benefits include:

This innovation reduces manual paperwork and strengthens governance transparency.

Building a governance framework requires structured planning and a clear roadmap.

Implementation Steps:

A structured framework promotes stability, reduces risks, and supports organizational growth.

Use this checklist as a governance guide:

Governance & Leadership

✔ Clear board structure

✔ Defined roles & responsibilities

✔ Independent director oversight

✔ Ethical standards framework

Compliance & Controls

✔ Strong internal controls

✔ Updated regulatory compliance software

✔ Timely policy reviews

✔ Accurate financial reporting

Risk Management

✔ Enterprise risk management program

✔ Cyber GRC & data protection

✔ Regular risk assessments

✔ Crisis management plan

Transparency

✔ Open stakeholder communication

✔ Reliable ESG reporting

✔ Executive compensation disclosure

✔ Clear audit trails

Technology & Tools

✔ GRC platform adoption

✔ Internal audit automation

✔ Board portal usage

✔ Compliance tools for tracking updates

This checklist ensures governance maturity across the organization.

Continuous improvement strengthens governance maturity:

Small upgrades compound into long-term governance excellence.

Corporate governance is important because it:

Organizations with strong governance outperform their competitors and recover faster from crises.

Corporate governance solutions are tools, frameworks, and policies that help organizations improve accountability, transparency, compliance, and risk management. They include GRC platforms, board portals, audit automation tools, and governance frameworks.

Corporate governance ensures ethical leadership, regulatory compliance, better decision-making, investor trust, and long-term business stability. It protects both stakeholders and shareholders.

A governance framework includes defined roles and responsibilities, internal controls, risk management, compliance processes, ethical standards, board oversight, and reporting structures.

GRC platforms centralize governance, risk, and compliance activities. They streamline policy management, automate audits, track regulatory changes, enhance cybersecurity governance, and improve reporting accuracy.

Compliance tools help track regulatory updates, manage policies, automate reporting, ensure internal control, and reduce compliance-related risks.

Strong governance increases transparency, reduces risks, ensures ethical leadership, and promotes stable growth—all of which attract investors and build long-term trust.

Corporate culture shapes everyday behavior and decision-making. A strong ethical culture strengthens governance, improves compliance, and reduces reputational risks.

The core principles include accountability, transparency, fairness, responsibility, ethical conduct, and long-term value creation.

Modern businesses operate in a world where accountability, transparency, and ethical behavior define long-term success. Corporate governance solutions powered by GRC tools, audit automation, ESG reporting, and advanced risk management enable companies to build a resilient, compliant, and stakeholder-centered culture.

Whether you are a growing enterprise or a global corporation, the path forward is clear:

Strong governance is not optional—it is your competitive advantage.

Subscribe to our newsletter and stay updated.