The Union Budget 2026 arrives at a time when businesses and professionals are seeking stability more than sudden relief. After several years of rapid regulatory change, the focus has gradually shifted toward clarity, predictability, and smoother compliance processes. Instead of headline-driven announcements, this budget leans into refinement. It addresses how people file returns, how businesses manage timelines, and how sectors align with long-term economic direction.

For taxpayers and enterprises alike, the budget signals continuity with correction. The intent appears to be reducing friction in everyday financial operations rather than introducing disruptive reforms. Understanding these changes early helps individuals and organizations make informed decisions around cash flow planning, compliance management, and operational strategy.

For individuals and salaried professionals, Budget 2026 maintains a familiar structure while quietly improving flexibility. Income tax slabs remain unchanged, which brings a sense of certainty to personal financial planning. While this may not offer immediate relief, it removes the uncertainty that frequent structural changes often create.

One of the more practical updates is the extension of timelines for filing revised and updated income tax returns. This allows taxpayers additional time to correct genuine errors without the pressure of penalties or rushed filings. In a system where documentation often comes from multiple sources, this change reduces anxiety and encourages more accurate compliance.

Another important adjustment relates to the Liberalized Remittance Scheme. Lower tax collected at source on education and medical expenses reduces the upfront financial burden for families sending funds abroad for essential purposes. Over time, this helps improve household cash flow management and reduces the gap between expense and refund.

Taken together, these measures indicate a shift toward compliance ease rather than enforcement intensity for individual taxpayers.

Small and medium enterprises continue to sit at the center of India’s economic engine, and Budget 2026 makes targeted adjustments to support their operational realities.

• Introduction of staggered income tax return filing timelines

• Clearer classification of manpower supply under contractor-related TDS provisions

• Gradual simplification of the minimum alternate tax framework

These updates address common pain points faced by MSMEs. Overlapping deadlines often strain limited finance teams, and staggered filing schedules reduce that pressure. Clarification around TDS classification lowers the risk of disputes and incorrect deductions, which have historically led to notices and cash flow disruptions.

Simplifying MAT provisions over time also helps businesses forecast tax liabilities more accurately. For smaller organizations operating on thin margins, predictability is often more valuable than incentives.

Startups and investors see more structural alignment than short-term benefit in this budget. One of the most notable changes is the treatment of share buybacks as capital gains rather than dividend income. This aligns domestic taxation with global practices but increases the tax responsibility on promoters and shareholders.

For founders, this change encourages more deliberate exit planning. Buybacks, once seen as a flexible route for capital return, now require careful evaluation of post-tax outcomes. Investors, on the other hand, gain greater transparency and consistency in how returns are taxed.

The clarification around MAT credit usage further strengthens financial planning for startups transitioning into profitability. While the changes may not reduce tax liability immediately, they improve visibility and reduce ambiguity.

Unlike budgets designed to stimulate short-term spending, Budget 2026 emphasizes system stability. The government appears to recognize that frequent policy shifts create operational friction, especially for compliance-driven functions like accounting, payroll, and taxation.

By extending timelines, clarifying rules, and reducing interpretational gaps, the budget supports better planning across sectors. Businesses can allocate resources more efficiently, professionals can manage compliance without constant recalibration, and investors gain confidence in regulatory consistency.

This approach reflects a broader policy direction where long-term economic trust is built through reliable processes rather than temporary concessions.

Budget 2026 continues India’s effort to position itself as a stable and attractive destination for global operations. Several changes focus on reducing friction for multinational companies, especially those operating in technology, consulting, and digital services.

Tax incentives for foreign cloud service providers using Indian data centers signal a strong push toward domestic infrastructure growth. This not only supports the local data ecosystem but also encourages global firms to anchor long-term operations in India rather than treating it as a peripheral market.

Expanded safe harbour rules reduce transfer pricing uncertainty, which has historically been a major concern for cross-border businesses. By offering clearer thresholds and predictable margins, the budget helps companies avoid prolonged disputes and administrative overhead. Relief for non-resident professionals further supports global talent mobility, making it easier for organizations to bring specialized expertise into India without complex tax consequences.

Together, these measures improve ease of doing business for international players while reinforcing India’s role in global value chains.

The digital economy receives steady, process-driven support rather than headline incentives. Budget 2026 strengthens areas that directly affect technology-driven businesses, including IT services, analytics, and cloud-based operations.

Higher safe harbour limits for IT services reduce pricing scrutiny and compliance uncertainty. Faster approvals for advance pricing agreements help companies plan multi-year operations with greater confidence. Encouragement of cloud infrastructure aligns with the growing reliance on data, dashboards, and real-time reporting across industries.

These updates matter because digital businesses depend heavily on predictability. When regulatory outcomes are clearer, organizations can focus on scaling services, improving efficiency, and investing in innovation instead of managing compliance risk.

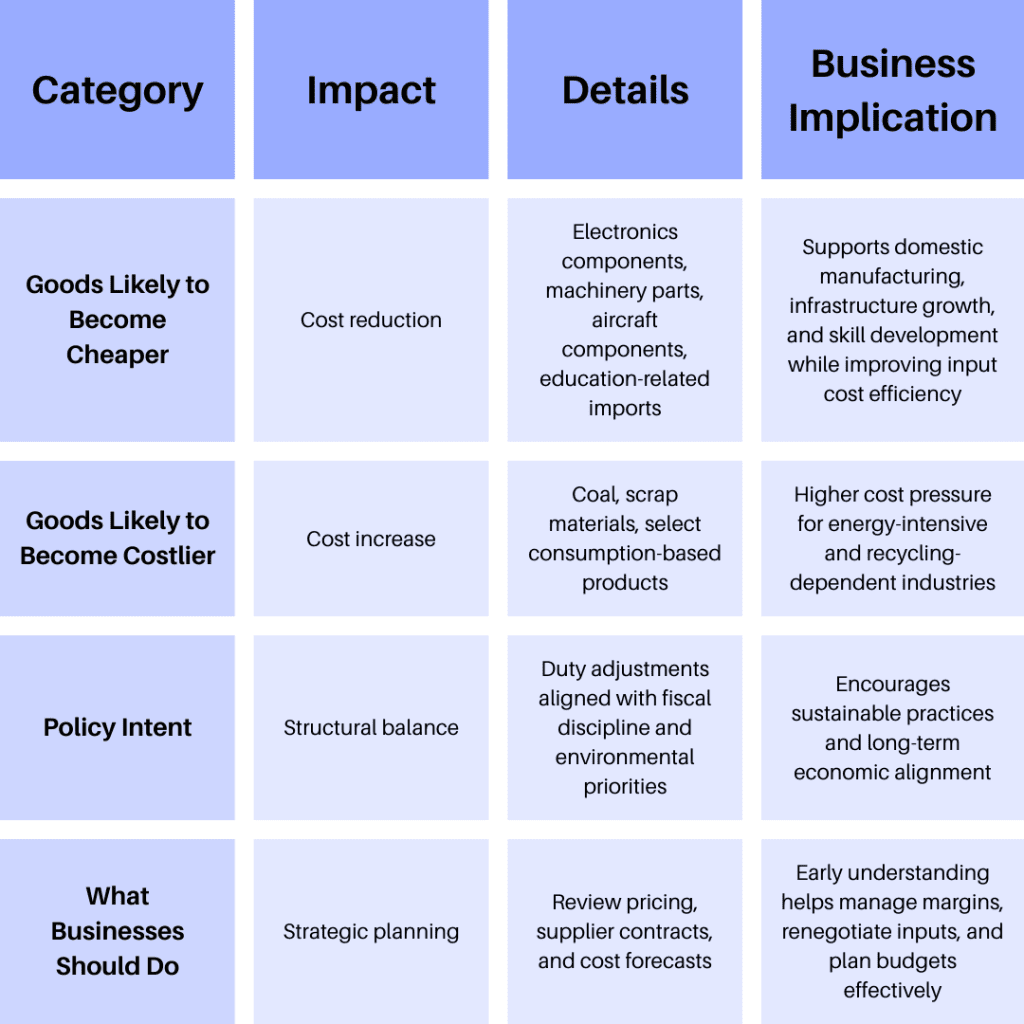

Indirect tax reforms under Budget 2026 focus on simplifying processes that directly affect working capital and cash flow. One of the most relevant changes is the rationalization of place of supply rules, particularly for intermediary services. Clearer definitions reduce confusion and lower the risk of mismatched tax positions across states.

The GST refund process has also been streamlined, addressing long-standing delays that affected exporters and service providers. Faster refunds improve liquidity and reduce reliance on short-term borrowing. Alignment between valuation rules and credit note provisions further reduces disputes and improves audit outcomes.

For businesses operating across multiple jurisdictions, these changes translate into smoother compliance and better cash flow predictability.

Union Budget 2026 emphasizes compliance clarity, predictable tax processes, and long-term stability rather than short-term relief measures.

No changes have been made to income tax slabs, helping individuals and salaried taxpayers plan finances with continuity and certainty.

The budget simplifies filing timelines, clarifies TDS rules, and improves tax predictability, easing compliance and cash flow management for MSMEs.

By taxing share buybacks as capital gains, the budget improves transparency but requires founders and investors to plan exits more carefully.

It strengthens business confidence by reducing disputes, supporting digital growth, and creating stable systems for sustainable economic planning.

Budget 2026 is not designed to create immediate excitement. Instead, it focuses on strengthening the systems that support long-term economic activity. By improving compliance clarity, reducing interpretational disputes, and supporting digital and global integration, the budget builds confidence across sectors.

For individuals, businesses, and international stakeholders, the real value of Budget 2026 lies in its emphasis on predictability and process improvement. Those who take time to understand these changes early will be better positioned to manage compliance, control costs, and plan sustainable growth.

Subscribe to our newsletter and stay updated.