- About us

- Outsourcing

- Strategic Finance

- Compliance & Tax

- Automation

- Group Companies

- Resources

- Career

In today’s global business environment, compliance and tax management are more than just legal obligations. They are essential for building a trustworthy, resilient, and future-ready business.

From startups filing their first corporate taxes to multinational companies managing global operations, businesses face challenges in regulatory compliance, tax reporting, and governance. Every transaction, report, and audit must align with national and international standards.

Digital tools like ServiceNow GRC and Archer GRC have transformed how organizations manage compliance. By automating processes, reducing errors, and providing real-time insights, these platforms empower CFOs and finance teams to make smarter, data-driven decisions.

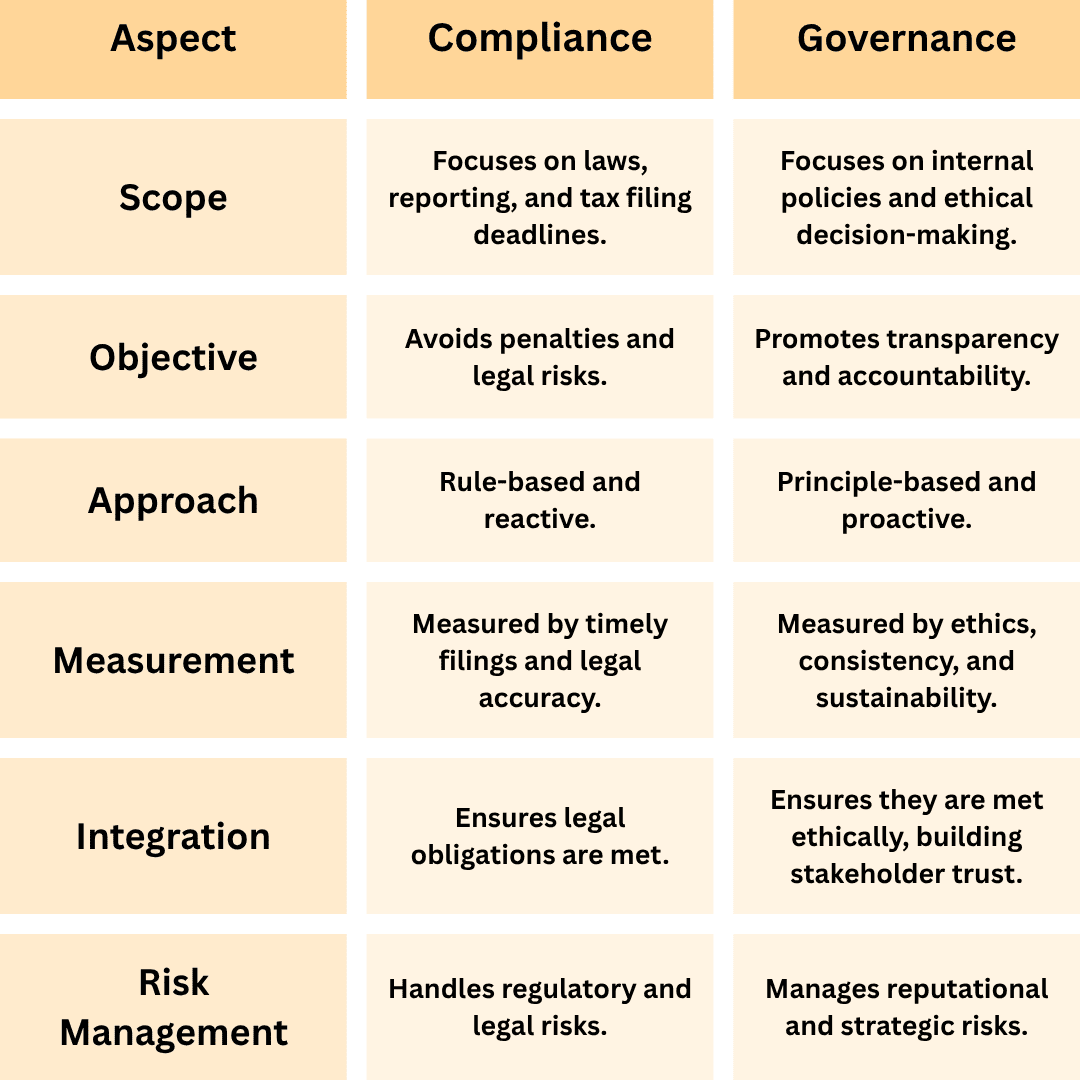

Compliance means adhering to laws, regulations, and internal company policies, ensuring that a business operates ethically, avoids legal risks, and protects its reputation. By following these standards, organizations can maintain trust with stakeholders, foster a culture of integrity, and minimize potential legal or financial penalties.

Compliance covers financial reporting, employee welfare, environmental responsibility, and more. Companies that prioritize compliance not only avoid penalties but also gain investor confidence and credibility.

Modern tools like ServiceNow GRC help track governance, risk, and compliance efficiently. Businesses can monitor data in real-time, manage audits smoothly, and strengthen overall governance.

Compliance and taxation are closely interconnected, as tax compliance ensures that a business maintains accurate financial reporting, submits tax filings on time, and fulfills all payment obligations correctly. Together, they help organizations meet legal requirements, avoid penalties, and maintain financial transparency and accountability.

For companies with international operations, regulatory compliance services are critical to aligning tax strategies across regions. This includes corporate tax compliance, withholding tax, and staying up-to-date with global regulations.

By combining tax and compliance into one framework, businesses reduce duplication, improve accuracy, and boost efficiency.

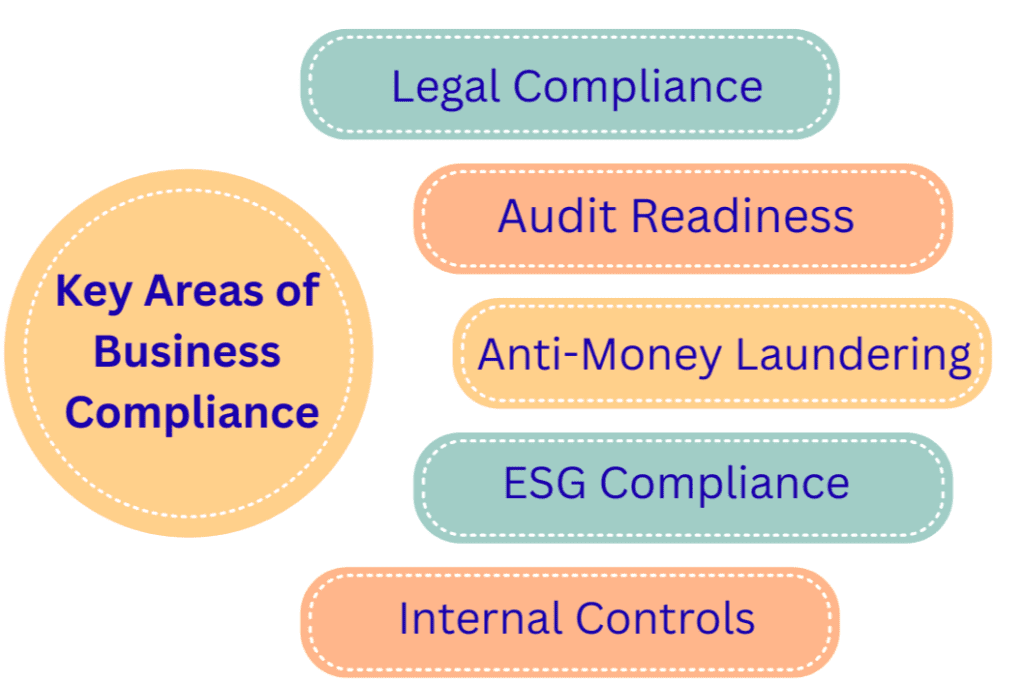

Modern compliance extends beyond taxes. Important areas include:

All businesses, regardless of size or industry, face a variety of compliance risks that can range from financial penalties and regulatory fines to significant reputational damage. To navigate these challenges effectively, organizations adopt risk-based compliance management, a structured approach that helps identify potential areas of non-compliance, evaluate the potential impact of each risk, and allocate resources strategically to address the most critical concerns. By prioritizing high-risk areas, companies can ensure that their efforts are both efficient and effective. Additionally, ongoing training programs, regular internal and external audits, and advanced monitoring tools play a crucial role in reducing risks, strengthening internal controls, and ensuring smooth, compliant operations across all departments. This proactive approach not only mitigates potential threats but also supports long-term organizational resilience and credibility.

Companies use AI, automation, and analytics to streamline global tax compliance and ensure accuracy across jurisdictions.

Digital tools make tax compliance faster, easier, and more accurate:

These tools help businesses stay compliant even as regulations evolve.

Many companies mistakenly treat compliance and tax planning as separate entities. In reality, effective tax planning thrives on strong compliance.

A compliant organization has accurate records, real-time financial insights, and clear documentation all of which form the foundation for optimized tax planning. Compliance and governance ensure that every deduction, credit, or benefit claimed aligns with legal requirements.

Moreover, regulatory compliance services and tax advisory professionals help organizations structure their operations to minimize risks while remaining compliant. From transfer pricing policies to cross-border tax strategies, compliance safeguards the financial planning process, reducing the likelihood of disputes or penalties.

Embedding compliance in company culture reduces risks and boosts credibility.

Regulatory compliance goes far beyond tax obligations; it reinforces a company’s reputation, ensures sustainability, and enhances investor confidence. Whether it’s following anti-money laundering compliance standards or ESG compliance policies, every aspect contributes to responsible business governance.

The importance of regulatory compliance in business is evident in how it prevents reputational harm and supports ethical growth. Non-compliance, on the other hand, can result in severe financial penalties and loss of stakeholder trust.

Businesses that integrate compliance within their corporate DNA are more likely to attract global investors, maintain operational resilience, and foster long-term success.

Startups and small businesses often underestimate the complexity of tax compliance requirements. However, early compliance helps them scale without facing financial or legal barriers later.

Typical startup tax obligations include:

To simplify this, many emerging companies use compliance services or digital accounting systems that automate tax reporting and reduce administrative overhead.

Corporate tax is undergoing a digital transformation. Emerging technologies such as blockchain, AI, and robotic process automation (RPA) are reshaping how companies manage and file their taxes.

Here are some innovations shaping corporate tax compliance globally:

These advancements not only simplify operations but also ensure consistent regulatory compliance across global markets. As digital ecosystems expand, automation will become the backbone of every successful tax department

Integrating compliance into overall business strategy transforms it from a cost center into a value driver. Companies that embed compliance management within corporate planning can:

When compliance and tax planning are seen as strategic enablers, they contribute directly to profitability, sustainability, and market reputation.

The Future of Compliance and Tax Is Transparent, Digital, and Ethical

In an age where data drives decisions and trust drives business, compliance and tax are no longer back-office tasks they are strategic imperatives. From regulatory compliance services and anti-money laundering compliance to ESG compliance and corporate tax planning, each element contributes to sustainable, responsible growth.

Businesses that embrace digital transformation, invest in automation, and foster a culture of governance will lead the next era of global business transparency. Compliance isn’t just about following rules it’s about leading with integrity, backed by technology and vision.

Subscribe to our newsletter and stay updated.