Indian companies especially in FMCG, aviation, and other import-dependent sectors are entering a challenging phase as input costs continue to rise sharply. A major contributor: the Indian rupee hitting a new historic low of ₹90.41 per US dollar in 2025.

With global crude, edible oils, chemicals, packaging materials, and aviation fuel prices already elevated, this steep drop in the rupee is pushing operational costs even higher for businesses across the country.

The Indian rupee has depreciated nearly 4% in 2025, touching an all-time low. Economists point to three major reasons:

The US Federal Reserve’s continued tight monetary stance strengthened the dollar globally.

Investors moved funds back to the US, causing emerging market currencies including the rupee to weaken.

India imports over 85% of its crude oil.

High global oil prices increased dollar demand for imports, putting downward pressure on the rupee.

Slowing global demand has impacted India’s export revenues.

Rising geopolitical tensions and global inflation triggered higher FPI outflows, weakening the rupee further.

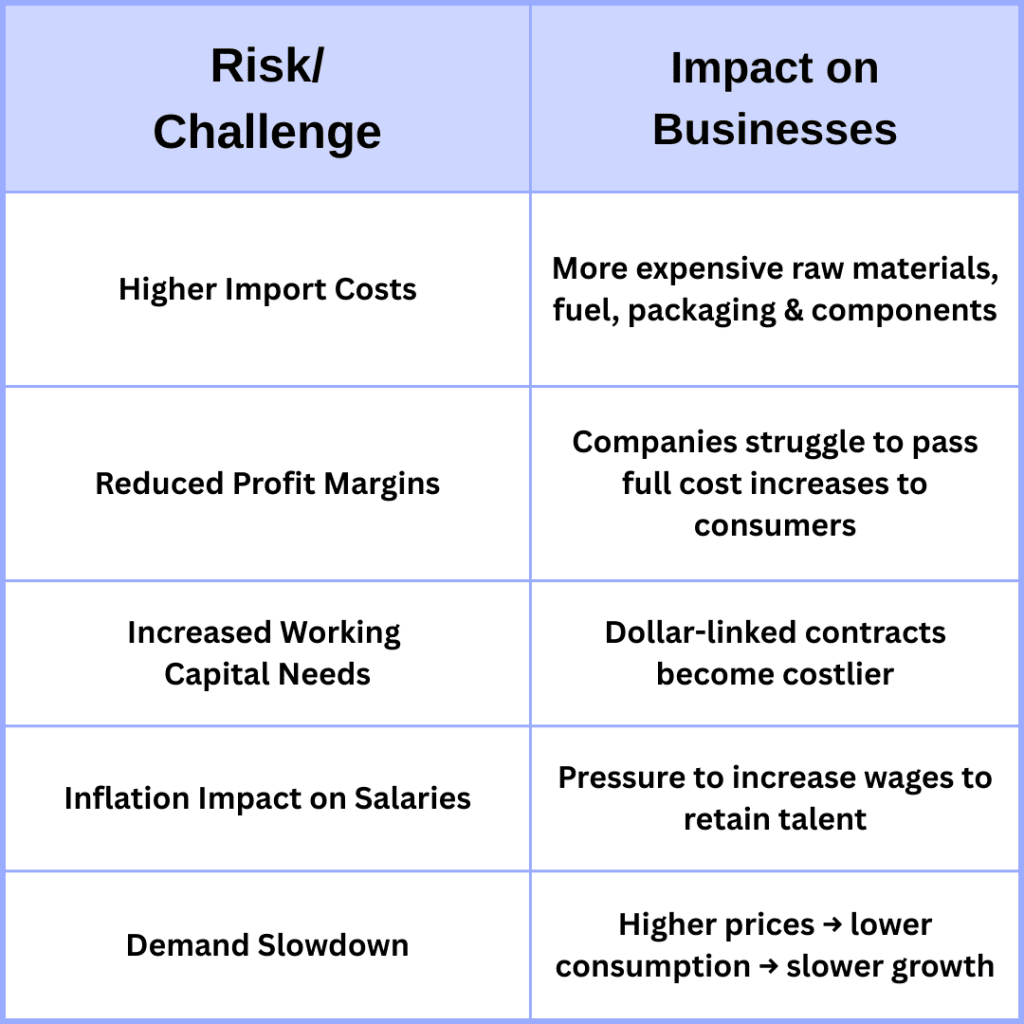

Net result: A weaker rupee → higher import costs → higher operational costs for Indian companies.

Imports of edible oils, crude derivatives, packaging materials, fragrances, and chemicals have become more expensive.

FMCG companies may:

Increase product prices

Reduce grammage

Introduce smaller pack sizes

Rework sourcing contracts

Urban consumer demand, already under pressure, may soften further.

Jet fuel (ATF), spare parts, and aircraft lease payments are all dollar-denominated.

With the rupee at 90+, operational costs rise drastically.

Airlines may face:

Narrower margins

Higher ticket prices

Increased likelihood of quarterly losses

Chemicals

Electronics

Logistics

Petrochemicals

Packaging

These sectors will experience margin erosion unless they secure hedging or renegotiate supply contracts.

To remain resilient, companies need to rethink strategy:

Identify dollar-linked expenses and renegotiate long-term contracts.

Explore multi-supplier models to reduce dependency.

Shift to local raw materials wherever feasible.

Partner with domestic packaging, ingredient, and logistics providers.

Introduce flexible pricing models.

Review pack sizes, margin thresholds, and distributor margins.

Automate supply chain, data reporting, and procurement.

Reduce wastage and energy inefficiencies.

Forward contracts

Currency swaps

Dollar pooling strategies

Build financial buffers for volatility.

Reassess budget frameworks and payroll impacts.

At Wisecor, we work closely with clients in industries that are directly affected by rupee depreciation and rising input costs.

Our support becomes critical in areas such as:

Cost forecasting and financial planning

Payroll & compliance management under inflationary pressure

Data analytics for cost optimization

Vendor management & procurement support

Risk mitigation and contract restructuring

With our technology-led outsourcing and analytics solutions, Wisecor helps organizations stay resilient in an increasingly volatile economic environment.

Rising global commodity prices + a depreciating rupee have created a difficult cost environment for Indian businesses. But with the right strategy cost optimization, analytics-driven decision-making, strong compliance planning, and operational efficiencies organizations can navigate this volatility more effectively.

Wisecor remains committed to helping businesses stay agile, stable, and future-ready.

Subscribe to our newsletter and stay updated.