- About us

- Outsourcing

- Strategic Finance

- Compliance & Tax

- Automation

- Group Companies

- Resources

- Career

As India steps into January 1, 2026, several new regulatory and compliance rules across banking, taxation, credit scoring, government service access, and salary structures have begun taking effect impacting individuals and businesses alike. These changes, framed to improve financial transparency and regulatory discipline, will influence borrowing, credit eligibility, compliance, employee salaries, and everyday transactions across sectors.

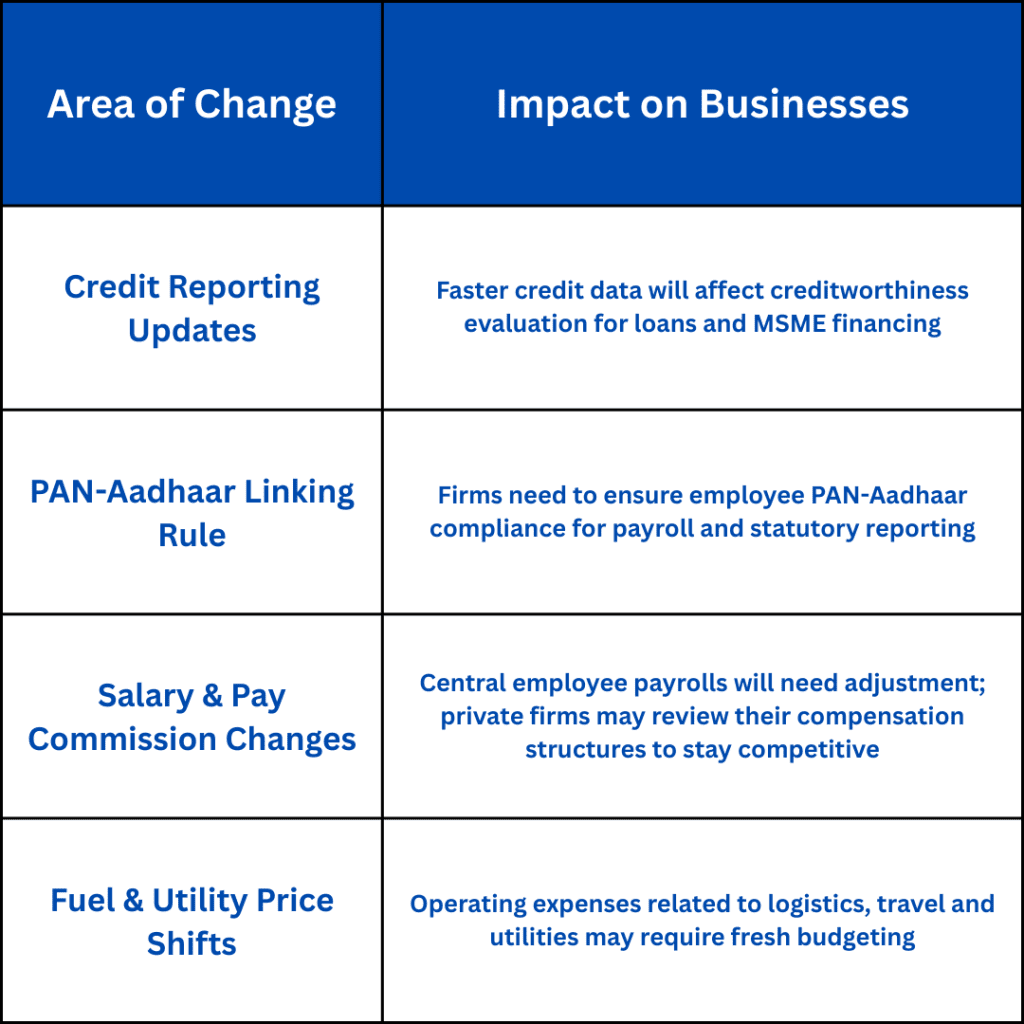

One of the biggest changes is to credit bureau reporting from January 1, credit bureaus will update customer repayment data on a weekly basis instead of once in 15 days. This means loan repayments, missed EMIs or improvements in credit behaviour will reflect in your credit score much faster. Faster updates can influence loan approvals, credit limits, and interest rates more dynamically than before.

From the start of the new year, linking your PAN with Aadhaar becomes mandatory to continue accessing banking services, tax filings, and government benefits. Non-linked PAN cards risk becoming inactive, which could disrupt banking transactions or refund processing unless completed promptly.

The 8th Pay Commission whose recommendations were cleared in 2025 officially comes into effect on January 1, 2026. This means central government employees and pensioners will see revised pay scales and allowances, although the actual disbursement may take time to reflect in salary charts.

Alongside credit and compliance changes, other regulatory shifts such as updates to fuel pricing (LPG and aviation fuel) and adjustments in public utility price structures are expected from this date with potential indirect impacts on household and business operating costs.

Businesses seeking working capital loans, equipment financing, or credit lines must track weekly credit score updates and ensure timely repayments to maintain strong credit profiles.

HR teams may need to update payroll systems to factor in 8th Pay Commission revisions for central government employees and reassess salary benchmarks for private staff to retain talent.

Ensuring all employees complete PAN-Aadhaar linking avoids blocked tax services or refund delays, which can impact financial planning and HR compliance reporting.

With revised pricing in fuel, utilities, and banking charges, firms must reforecast budgets especially in logistics, travel, supply chain, and operational expense lines.

At Wisecor, our core services payroll management, HR compliance, statutory reporting and financial planning

are directly aligned with these regulatory shifts.

Here’s how we help businesses adapt:

PAN & Aadhaar Compliance Monitoring: Ensure all employee records are validated to avoid service disruption.

Credit Score & Loan Readiness Support: Assistance with credit reporting insights and loan eligibility strategies.

Payroll System Upgrades: Updating salary structures, allowances and compliance tools.

Expense Forecasting & Budget Advisory: Cost impact assessment for fuel, utilities, and operational costs.

With automated tools and compliance frameworks built for changing regulations, Wisecor equips organisations to stay ahead and manage transitions smoothly.

The regulatory changes effective from January 1, 2026 reflect a broader shift toward digital, transparent, and disciplined governance across finance, employment, and compliance sectors. While these updates may require adjustments from businesses and HR teams, they also strengthen credit behaviour monitoring, taxation accuracy, employee welfare provisions, and financial accountability.

Staying informed and compliant early in the new year will help organisations minimise risk, optimise costs, and enhance operational resilience.

Wisecor remains committed to guiding clients through this new regulatory landscape with clarity, accuracy and technology-driven solutions.

Subscribe to our newsletter and stay updated.