- About us

- Outsourcing

- Strategic Finance

- Compliance & Tax

- Automation

- Group Companies

- Resources

- Career

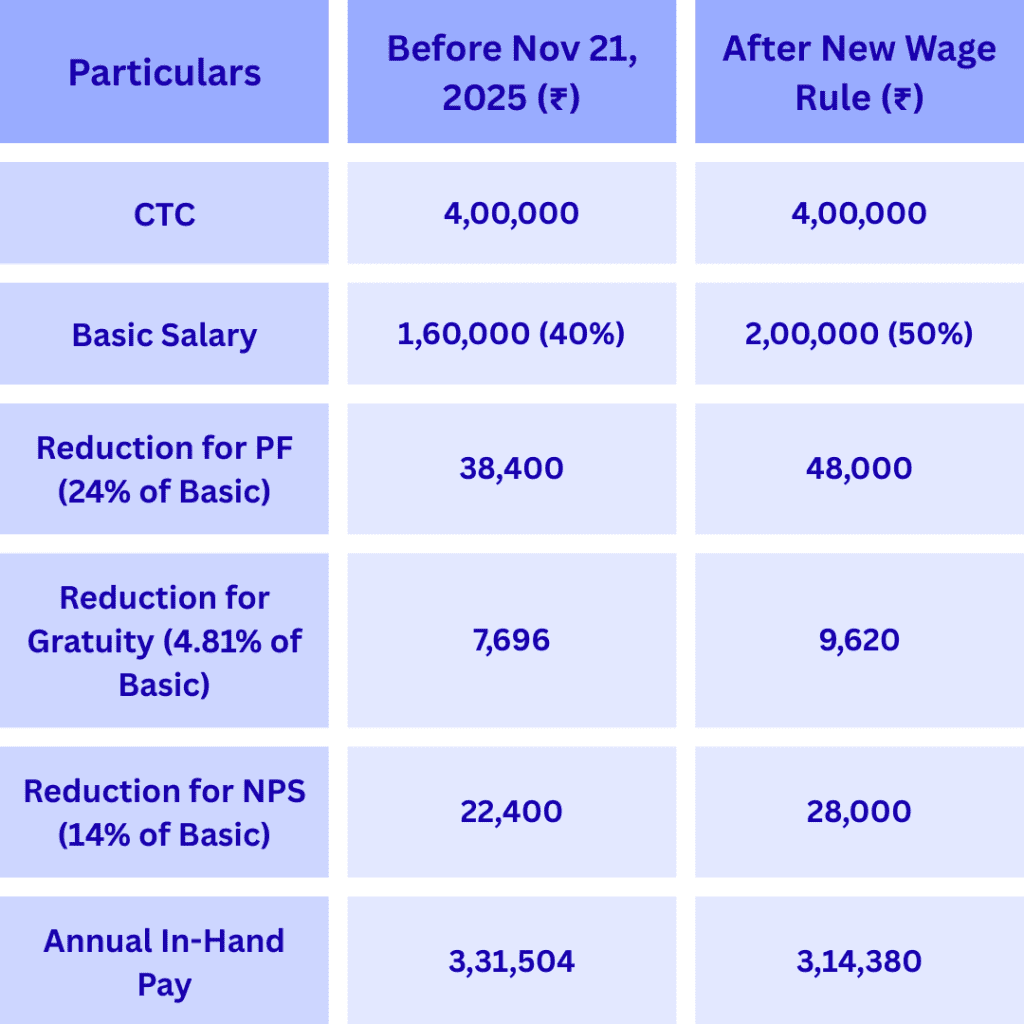

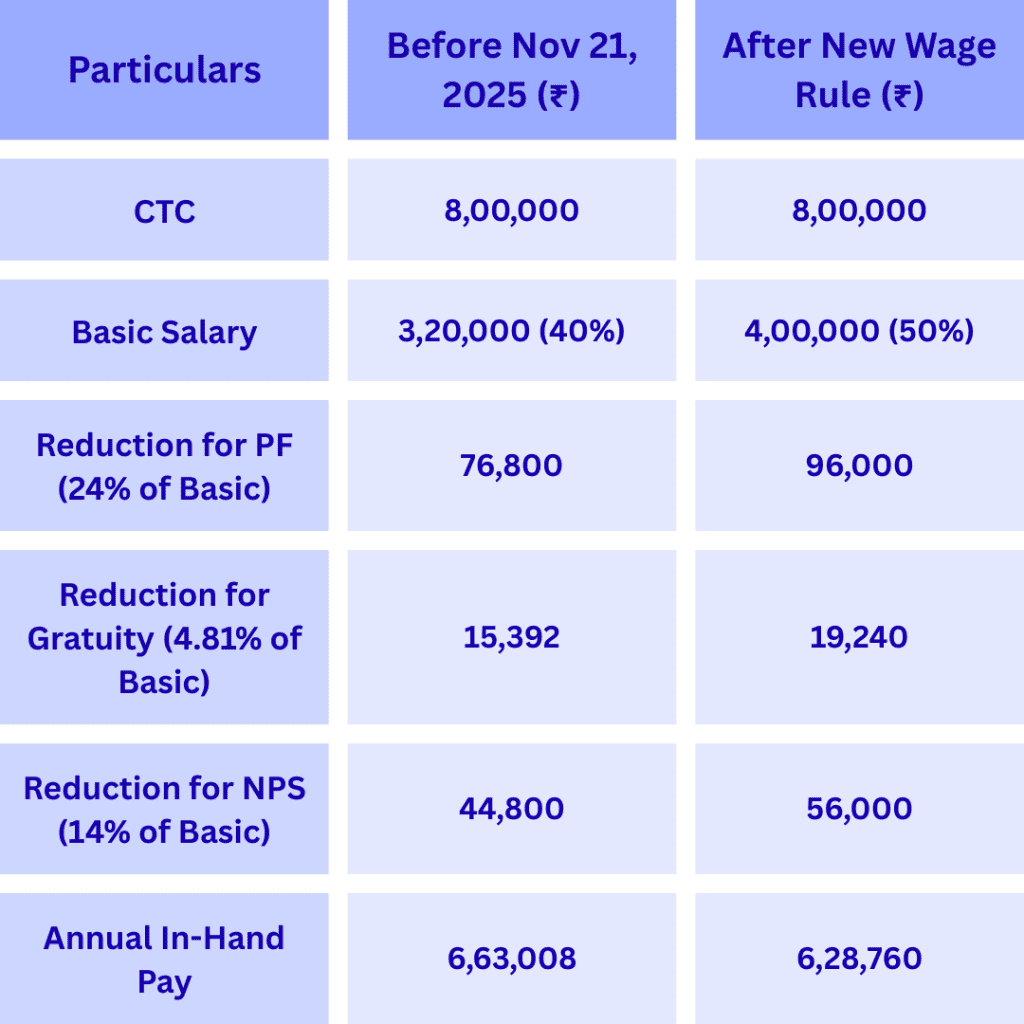

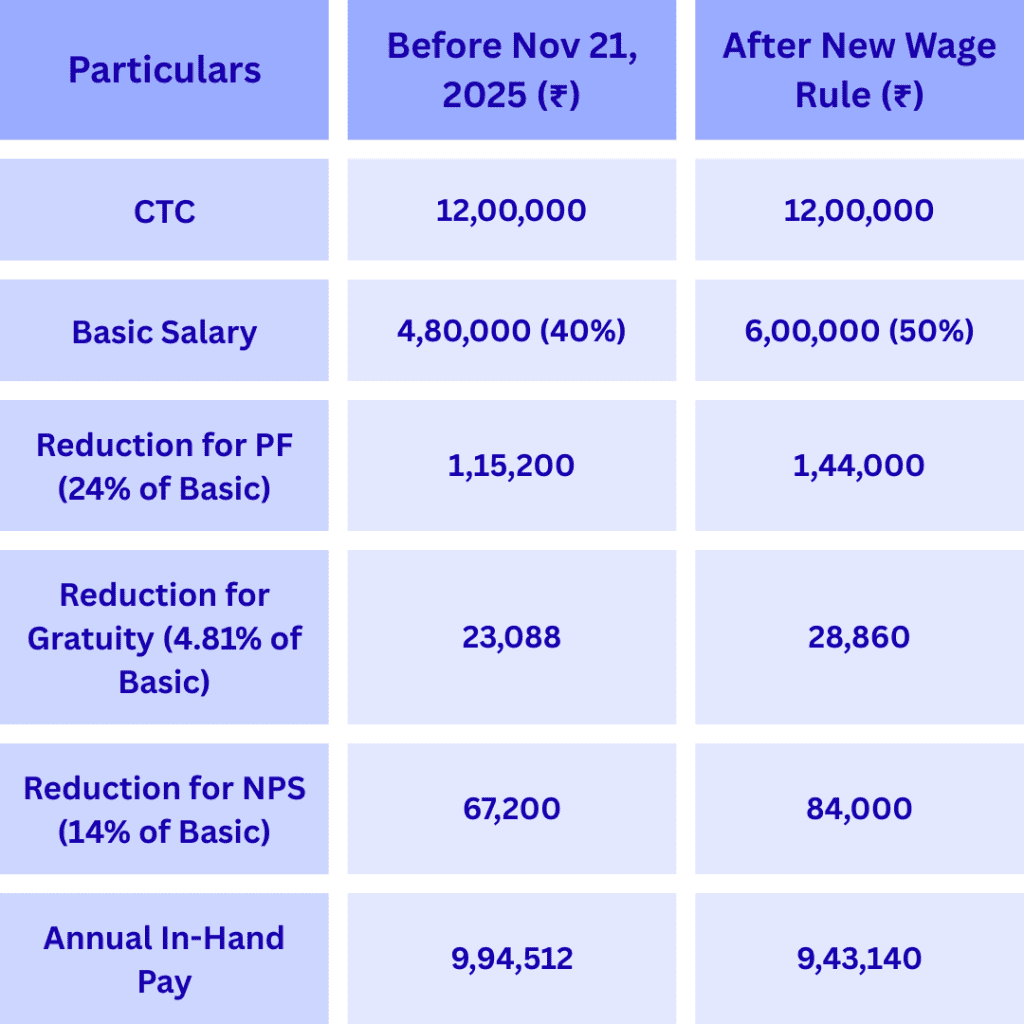

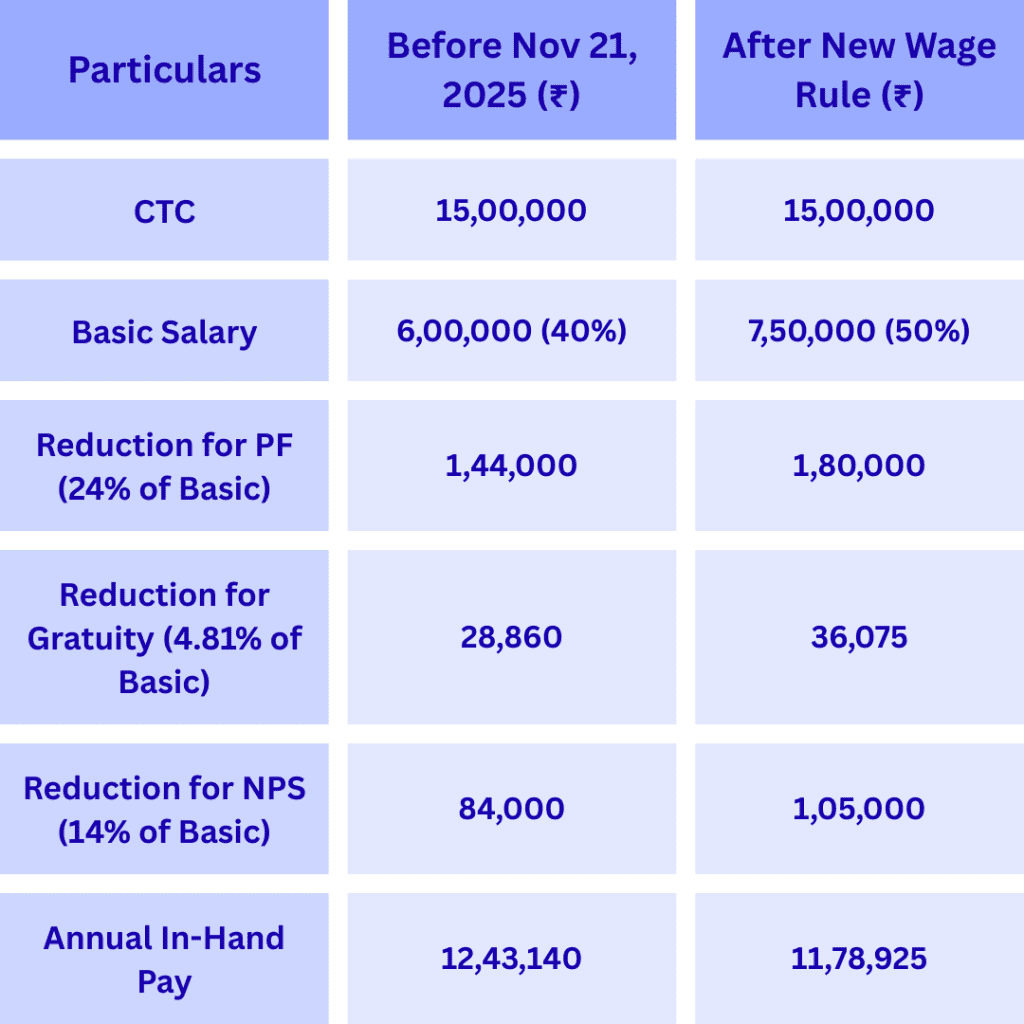

The Government of India’s updated wage framework part of the new Labour Codes has officially changed the way salaries are calculated across industries. With the 50% rule on “wages” now applicable, salary components like Basic, HRA, PF, and allowances have been standardized to bring more transparency and social-security coverage.

As a result, employees across all salary brackets from ₹4 lakh to ₹15 lakh CTC will now see updated in-hand pay calculations. While take-home pay may slightly reduce due to higher PF and gratuity contributions, long-term benefits, retirement security, and financial stability increase significantly.

This update has been widely discussed across national financial platforms, including Upstox, as organizations begin restructuring payroll for compliance.

Under the new wage structure:

“Wages” (Basic + DA) must be at least 50% of total CTC.

Allowances combined cannot exceed 50% of CTC.

PF is calculated on Basic, so a higher Basic results in higher PF contribution.

Gratuity becomes more predictable as it is tied to the uniform wage definition.

Take-home salary may reduce, but savings and retirement fund growth improve.

These changes create a more standardized, fair, and transparent salary system across industries.

Higher PF contributions from both employer and employee increase long-term financial security.

Employees clearly understand how much goes to Basic, allowances, PF, and in-hand.

With the standardized wage definition, gratuity becomes more uniform across industries.

Knowing the exact in-hand salary helps employees plan EMI, investments, and expenses better.

As organizations transition to the new rules, HR and payroll teams may face:

Every employee’s salary structure must align with the 50% wage rule.

HRMS and payroll tools must be updated to avoid miscalculations.

Increased PF & gratuity contributions may impact financial planning for companies.

Businesses must ensure there is no deviation in wage rule implementation.

At Wisecor Global, we actively support companies in re-aligning payroll and HR frameworks to stay compliant under the new laws.

✔ Payroll restructuring aligned with new wage rules

✔ Automated payroll management with updated regulatory parameters

✔ Digital salary slips, PF computation, and real-time compliance alerts

✔ Full integration of wage code changes into HRMS platforms

✔ Gratuity forecasting & statutory audit support

✔ Advisory for cost optimisation under the new structure

With our expertise in Payroll Management Services, Payroll Outsourcing, and Statutory Compliance, we ensure your teams experience a smooth, error-free transition.

The new wage rules bring India closer to a modern, transparent, and employee-centric salary system. While take-home pay may slightly adjust, the long-term value created through PF, gratuity, and social-security benefits is substantially higher.

And with Wisecor’s end-to-end payroll expertise, businesses can confidently implement these changes without disruption.

Subscribe to our newsletter and stay updated.