India’s Free Trade Agreement with the European Union marks one of the most consequential trade developments in the country’s recent economic history. Unlike earlier trade arrangements that focused on selective tariff reductions, the India–EU FTA reshapes how Indian businesses engage with one of the world’s largest and most regulated markets.

The European Union represents over 450 million consumers and a highly mature import ecosystem. For Indian exporters, manufacturers, and service providers, this agreement is not just about cost savings it is about long-term access, credibility, and competitiveness in a demanding global marketplace.

What makes this agreement particularly important is its depth. It goes beyond headline tariff reductions and touches areas such as market access, regulatory cooperation, standards alignment, and services liberalisation. For businesses prepared to adapt, this creates a structural advantage that did not exist earlier.

Unlike many bilateral agreements signed in the past, the India–EU FTA is designed to influence how Indian companies operate, not just what they export.

Earlier trade deals primarily focused on tariff relief. This agreement, however, places equal importance on:

The EU is among the most compliance-driven markets in the world. Gaining smoother access to it automatically improves the global standing of Indian exporters. In many ways, this agreement positions Indian companies to compete not just on cost, but on quality, consistency, and reliability.

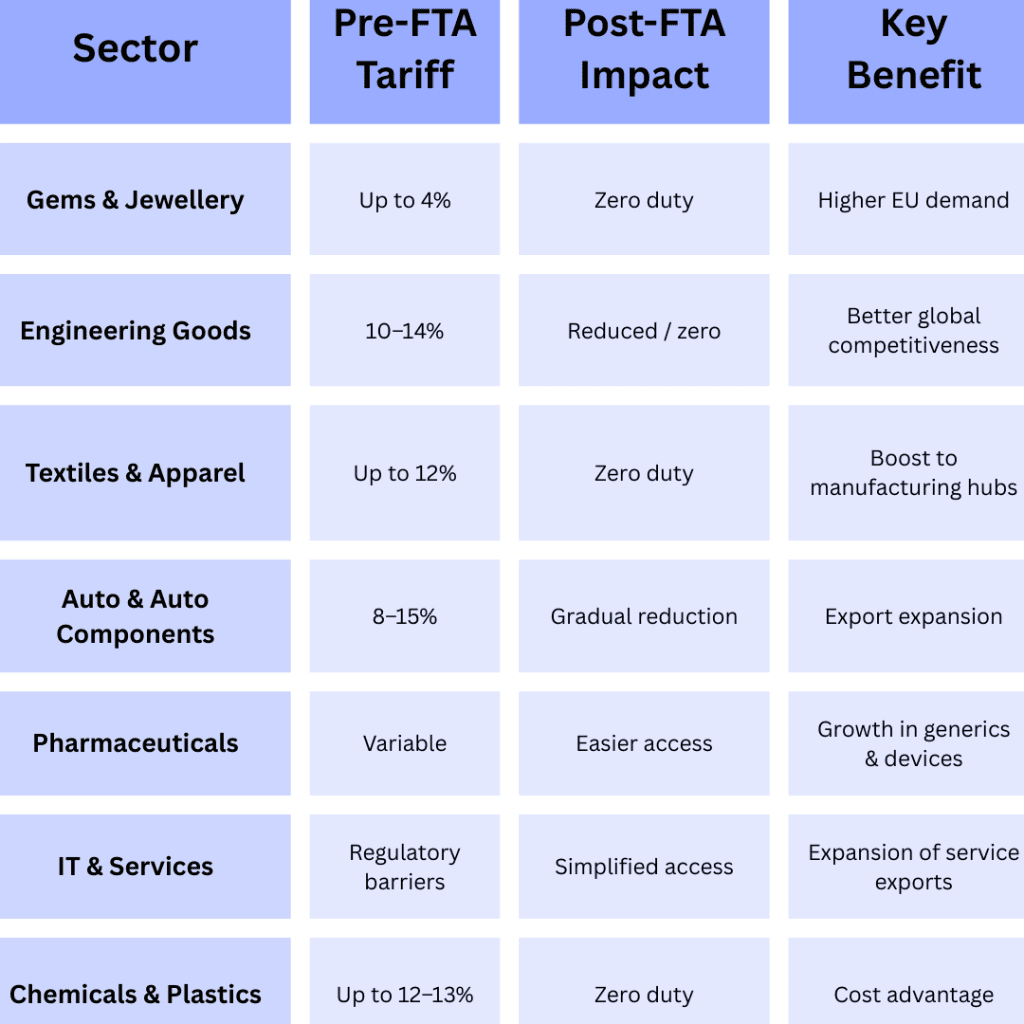

The most visible impact of the agreement is seen across key export-driven industries. While the tariff reductions vary by sector, the common theme is improved competitiveness and market access.

The gems and jewellery sector stands to gain significantly, with import duties in the EU reducing to zero for a wide range of products. Earlier, Indian jewellery exports faced duties of up to 4 percent, which affected pricing in a highly competitive luxury market.

With duty-free access, Indian manufacturers can offer better pricing while maintaining margins. This is particularly beneficial for MSME-driven clusters in Gujarat, Maharashtra, Rajasthan, and West Bengal, where a large part of India’s jewellery manufacturing base is concentrated.

The agreement also strengthens India’s position as a reliable sourcing hub for high-quality finished jewellery in European markets.

Engineering exports form a major share of India’s trade with the EU. Prior to the FTA, duties ranging from 10 to 14 percent reduced competitiveness against suppliers from countries with preferential access.

The agreement significantly lowers these barriers, making Indian machinery, auto components, industrial equipment, and capital goods more attractive to European buyers. Over time, this is expected to drive higher exports, increased manufacturing capacity, and deeper integration of Indian suppliers into European value chains.

This sector is also expected to benefit from improved technology transfer and collaboration with EU-based manufacturers.

Textiles remain one of India’s most employment-intensive sectors, and the FTA offers a strong boost to its global competitiveness. With tariffs earlier reaching up to 12 percent, Indian textile exporters often struggled to compete with countries enjoying preferential access.

The removal of these duties allows Indian manufacturers to price more competitively in the European market. This is likely to accelerate growth in textile clusters across Tamil Nadu, Gujarat, Maharashtra, Rajasthan, Uttar Pradesh, and West Bengal.

Beyond pricing, the agreement also encourages improvements in sustainability, traceability, and compliance areas increasingly demanded by European buyers.

India already holds a strong position as a global pharmaceutical supplier. The FTA further strengthens this role by easing access to the European pharmaceutical and medical devices market, valued at over USD 500 billion.

Reduced tariffs, streamlined regulatory pathways, and clearer market access norms benefit Indian exporters of generics, APIs, and medical equipment. Over time, this is expected to improve India’s standing as a dependable healthcare supplier to Europe, especially in cost-sensitive segments.

The chemicals sector benefits from near-complete tariff elimination under the agreement. Earlier duties of around 12–13 percent limited competitiveness in price-sensitive European markets.

With tariffs reduced, Indian chemical manufacturers gain improved access to industrial buyers across the EU. This is likely to drive capacity expansion in major chemical hubs such as Gujarat, Maharashtra, and Tamil Nadu.

However, this sector will also face stricter environmental and safety compliance requirements, making regulatory preparedness crucial.

While services do not follow the same tariff structure as goods, the FTA creates a more predictable framework for IT, digital services, and professional services.

Improved mobility provisions, recognition frameworks, and data cooperation enhance opportunities for Indian IT firms, consulting companies, and digital service providers to expand operations in Europe.

This strengthens India’s position not just as a service provider, but as a long-term technology partner.

The most immediate impact of the agreement is cost competitiveness. Lower or zero duties reduce landed costs, allowing Indian exporters to compete more effectively with suppliers from other regions.

At the same time, the agreement improves:

For many businesses, this is the difference between occasional exports and sustained international expansion.

While the FTA simplifies trade, it also raises expectations.

Businesses will need to pay closer attention to:

European buyers place heavy emphasis on transparency and regulatory discipline. Companies that treat compliance as a strategic function rather than a formality will benefit the most.

Small and mid-sized enterprises stand to gain significantly, provided they prepare well. The FTA levels the playing field by removing tariff disadvantages that earlier favoured larger exporters.

Manufacturing-led businesses, export-oriented units, and companies with scalable operations will find new growth opportunities.

At the same time, enterprises that already maintain strong compliance practices and international quality standards will see faster market entry and higher buyer confidence.

To fully benefit from the India–EU FTA, businesses should begin preparing on multiple fronts:

The agreement rewards preparation. Those who act early will gain a sustainable advantage.

The India–EU Free Trade Agreement is not just a policy milestone. It is a structural shift in how Indian businesses participate in global trade.

For companies willing to adapt, invest in compliance, and think long-term, the FTA opens doors to one of the world’s most valuable markets. The opportunity is significant, but so is the responsibility to operate at global standards.

In the coming years, success will belong not to those who export more, but to those who export smarter.

Subscribe to our newsletter and stay updated.