- About us

- Outsourcing

- Strategic Finance

- Compliance & Tax

- Automation

- Group Companies

- Resources

- Career

For businesses handling physical products whether retail, manufacturing, distribution, or warehousing inventory accuracy is critical. An efficient audit process not only validates stock records but also strengthens compliance, financial reporting, and operational efficiency.

This guide provides a detailed framework covering:

What an inventory audit is

Why it matters

Pre-audit preparation checklist

Step-by-step audit process

Roles and responsibilities

Best practices & tools

Reporting and actionable insights

An inventory audit is the process of verifying the quantity, condition, and value of physical stock and matching it against the records maintained in the company’s accounting or inventory management system.

It ensures:

Accuracy – stock data in the system matches actual physical items.

Loss Prevention – theft, misplacement, or damage is identified early.

Financial Compliance – correct stock valuation for balance sheets, tax, and statutory reporting.

Better Decision-Making – accurate data improves demand forecasting, purchasing, and operational planning.

Different businesses use different audit methods depending on their size, stock complexity, industry regulations, and internal control needs. The four most common audit types are:

A comprehensive physical verification of all inventory items in a warehouse, store, or production facility. Every item is counted, inspected, and reconciled with system records.

Instead of auditing all stock at once, cycle counting audits a subset of inventory on a rotational basis (daily, weekly, or monthly). Over time, all items are audited without disrupting operations.

A random, unannounced check of selected inventory items to verify accuracy and detect irregularities such as theft, misplacement, or fraud.

An external auditor or consulting firm is engaged to verify inventory for compliance, financial accuracy, or certification purposes.

Inventory audits are crucial for ensuring that stock records match reality, reducing errors that impact finances and operations. They help prevent losses from theft, damage, or misplacement while maintaining compliance with tax and regulatory requirements. Regular audits improve cash flow management, support smarter purchasing decisions, and enhance overall business efficiency. In short, they safeguard profitability and build trust with stakeholders.

Financial Accuracy: Prevents misstated balance sheets and profit margins.

Loss Prevention: Detects theft, spoilage, damage, and shrinkage.

Operational Efficiency: Optimizes purchasing, storage, and cash flow.

Regulatory Compliance: Ensures adherence to tax, GST, and statutory requirements.

Decision-Making: Provides data for demand forecasting and business strategy.

A successful inventory audit begins long before you start counting items. It requires structured planning, a reliable checklist, and a team that understands the objective. Whether you’re preparing for an internal review or a third-party audit, having a system in place makes all the difference.

Here’s a detailed pre-audit checklist:

Ensure your ERP, POS, or Excel sheets reflect the latest transactions (purchases, sales, transfers).

Reconcile recent shipments and returns before starting.

Close pending stock entries to prevent mismatches.

Gather barcode scanners, RFID devices, tablets, or mobile audit apps.

Ensure tools are tested, charged, and connected to your system.

Keep backup tally sheets in case of device failure.

Organize stock by category, batch, expiry, or storage zone.

Clearly label shelves, bins, and pallets to speed up counting.

Separate quarantined, damaged, or obsolete items before the audit.

Decide whether to use internal staff or external auditors.

Train team members on counting methods, tools, and audit templates.

Assign roles: counters, verifiers, recorders, and supervisors.

Use Excel, Google Sheets, or inventory software templates for consistency.

Pre-define fields like SKU, batch, location, quantity, condition, notes.

Standardization prevents data entry errors and eases reconciliation.

Announce the audit schedule well in advance.

Freeze stock movement (inbound/outbound) during counting.

Document the baseline inventory status before freezing.

Keep purchase orders, invoices, GRNs (Goods Receipt Notes), and dispatch slips accessible.

Ensure stock policies (valuation, write-offs, damaged stock handling) are documented.

Confirm audit scope complies with company policies and regulatory requirements.

A successful inventory audit doesn’t happen by chance it requires planning, structure, and consistency. Whether you’re conducting a routine check or preparing for a financial year-end close, following a clear step-by-step process can ensure accuracy and compliance.

Here’s how to conduct an effective inventory audit from start to finish:

Define audit scope (full, cycle, spot).

Assign roles (counters, verifiers, supervisors).

Set audit dates and notify all teams.

Halt inbound/outbound stock flows.

Record stock status as baseline.

Conduct item-by-item counts using scanners/tags.

Check condition, expiry dates, and storage accuracy.

Use two-person teams (one counts, one records).

Compare system vs. physical count.

Categorize discrepancies: loss, misplacement, damage, errors.

Revalue obsolete or slow-moving items.

Prepare an audit report with discrepancies, causes, and recommendations.

Implement corrective actions (e.g., new stock controls, improved labeling).

Track performance improvements over time.

An inventory audit is more than just a compliance activity — it’s a strategic tool that improves accuracy, reduces losses, and drives operational efficiency. Understanding its objectives and the people responsible for executing the audit is key to making the most of the process.

The main goal of an inventory audit is to verify that the physical stock matches the recorded data. But beyond this basic purpose, there are several deeper objectives:

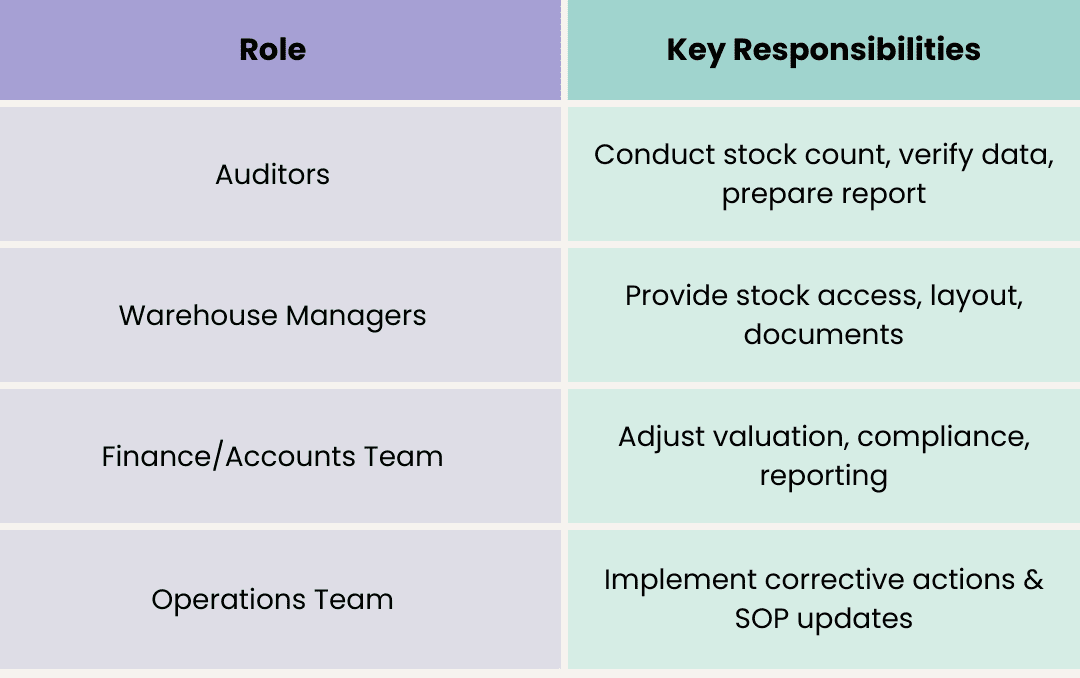

An audit requires coordination between departments. Here are the typical duties and responsibilities:

To ensure consistent and effective audits over time, businesses should follow these proven practices:

Once the inventory audit is completed, the final and most critical step is reporting. A well-documented inventory audit report not only communicates findings but also drives improvements in internal controls and operations.

An audit report typically summarizes:

Pro Tip: Keep your report easy to interpret with charts, tables, and checklists. If you’re working with external auditors, they may also attach a formal opinion letter or certification.

Example: Inventory Audit in Action

Let’s say a retail company conducted a quarterly audit and found the following:

The final report recommended real-time stock tracking, markdowns on outdated items, and periodic cycle counts. As a result, the company reduced waste by 12% in the next quarter and optimized storage.

This illustrates how small changes, backed by data, can lead to measurable outcomes.

Technology can significantly reduce the time and effort needed to carry out a comprehensive inventory audit. Here are some effective tools:

Choosing the right tools depends on the size of your operations, budget, and integration needs.

A stock or inventory audit may sound like a back-end function, but in reality, it’s a frontline strategy for building business resilience. Accurate inventory records prevent financial discrepancies, empower better decisions, and reduce unnecessary costs. Whether you’re running a retail chain, a manufacturing unit, or a warehouse the right audit process can uncover hidden inefficiencies and unlock growth potential.

Don’t treat inventory audits as just a checkbox for compliance see them as an investment in transparency, efficiency, and trust.

If you’re starting your audit process or looking to upgrade your current practices, begin with a simple checklist, build consistency, and invest in the right technology. You’ll not only boost operational control but also build long-term credibility with your stakeholders.

Subscribe to our newsletter and stay updated.