Have you ever wondered why some businesses thrive financially while others constantly struggle to manage their numbers? The difference often lies in how effectively they use financial accounting. Financial accounting is not just about recording transactions it is the backbone of every successful business. It provides the framework for transparency, compliance, strategic decision-making, and long-term growth. A business without proper financial accounting is like a ship without navigation it may move forward, but it risks heading in the wrong direction.

According to research, nearly 82% of small businesses fail due to poor cash flow management. This statistic highlights why accurate financial tracking and reporting are not optional but essential. By systematically recording income, expenses, assets, and liabilities, financial accounting offers a clear and reliable picture of a company’s financial health.

Without structured financial accounting, companies are exposed to serious challenges, including:

Mismanaged Cash Flow – Difficulty in balancing inflows and outflows, leading to liquidity crises.

Inaccurate Planning – Poor budgeting and forecasting that hinder growth strategies.

Non-Compliance Risks – Penalties and fines for failing to meet tax or regulatory requirements.

Loss of Investor Trust – Investors, banks, and partners may hesitate to engage with a business that lacks transparency.

On the other hand, businesses that embrace financial accounting benefit in several ways:

Credibility & Trust – Clear records improve reputation with stakeholders.

Investor Attraction – Reliable financial statements make it easier to secure funding and partnerships.

Better Decision-Making – Access to accurate data enables smarter business strategies.

Sustainable Growth – By monitoring performance, companies can adapt, scale, and remain competitive.

In today’s dynamic business world, financial accounting is not just a back-office function. It is a strategic tool that shapes a company’s future, enhances stability, and drives profitability.

Financial accounting is the systematic process of recording, classifying, summarizing, and reporting financial transactions of a business. It forms the backbone of a company’s financial management by ensuring that all money coming in and going out is properly documented and analyzed.

At its core, financial accounting answers three critical questions for any business:

What do we own and what do we owe? (Assets and Liabilities)

How much did we earn or lose? (Revenue and Expenses)

How healthy is our cash flow? (Liquidity and Sustainability)

This discipline provides a structured framework for presenting financial data in a way that stakeholders business owners, managers, investors, creditors, auditors, regulators, and even employees can understand and trust.

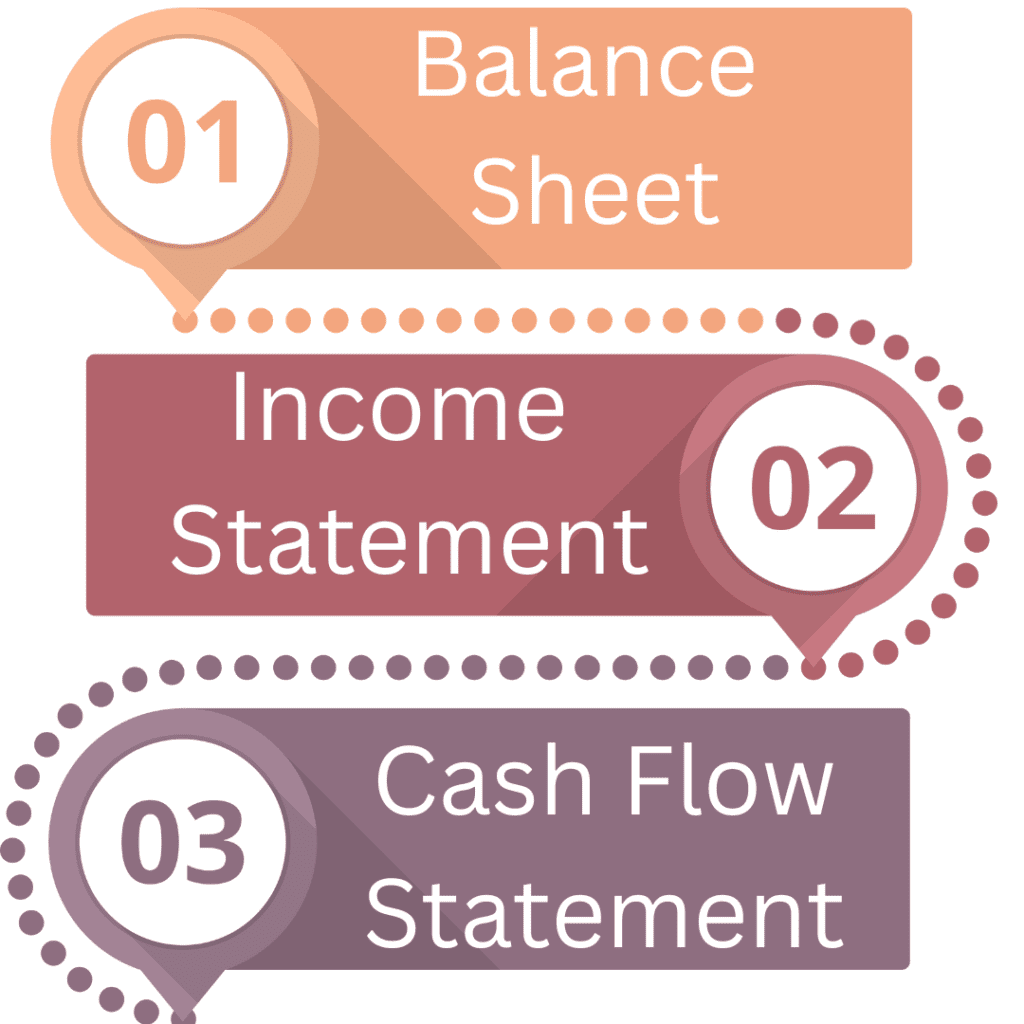

Balance Sheet

Provides a snapshot of a company’s financial position at a specific point in time.

Shows assets (what a company owns), liabilities (what it owes), and equity (owner’s value).

Example: If a company has $500,000 in assets and $300,000 in liabilities, the owner’s equity is $200,000.

Income Statement (Profit & Loss Statement)

Measures profitability over a set period (monthly, quarterly, yearly).

Records revenues, expenses, and net income (or loss).

Example: If revenue is $200,000 and expenses are $150,000, the company made a net profit of $50,000.

Cash Flow Statement

Tracks the actual movement of money in and out of the business.

Divided into operating activities, investing activities, and financing activities.

Example: A company might show profit on the income statement but still face cash shortages if customers delay payments.

Historical in Nature – Focuses on past financial data to evaluate performance.

Standardized – Uses global frameworks like GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards) to maintain consistency.

Objective and Verifiable – Based on evidence such as invoices, receipts, and contracts.

For External Use – Primarily designed to communicate financial health to outsiders like investors, regulators, and banks.

Decision-Making: Provides reliable data for business planning and resource allocation.

Compliance: Ensures adherence to tax laws, financial regulations, and auditing requirements.

Transparency: Builds trust with investors, partners, and creditors.

Performance Evaluation: Allows businesses to measure profitability, growth, and efficiency.

Financial accounting is often called the backbone of business success because it influences almost every decision and operation within a company. Here’s why it plays such a vital role:

Ensures Accurate Record-Keeping

Every transaction from a small office purchase to a million-dollar deal needs to be tracked and organized.

Accurate records prevent confusion, fraud, and financial discrepancies.

For example, if a company misplaces supplier invoices or fails to record client payments, it may face cash flow shortages even if sales are strong.

Builds Trust with Stakeholders

Investors, banks, regulators, and even employees expect transparency.

Clear, verifiable records increase confidence in the business’s performance and stability.

A company that consistently produces audited financial reports is more likely to attract investors and partnerships than one with incomplete or unclear data.

Supports Legal and Regulatory Compliance

Businesses must comply with frameworks like GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards).

Proper accounting ensures taxes are filed correctly, financial reports are accurate, and the business avoids penalties or legal consequences.

Compliance also strengthens reputation and builds long-term sustainability.

Guides Decision-Making

Financial statements provide real-time data that helps managers and business leaders decide whether to expand, cut costs, hire new staff, or launch products.

For instance, a positive cash flow report may encourage opening a new branch, while negative trends may push leaders to reduce expenses.

Prevents Business Failure

According to studies, 82% of small businesses fail due to poor cash flow management.

Financial accounting identifies cash leaks, tracks receivables, and highlights risky spending habits.

By analyzing reports, companies can take corrective action before problems escalate into losses or bankruptcy.

In essence, financial accounting is not just about “numbers on paper.” It is a strategic tool that builds credibility, reduces risks, and ensures businesses can grow confidently.

While financial accounting is an ongoing necessity for every business, some situations make it even more critical:

During the Start-up Stage

Start-ups must track seed funding, expenses, and early revenues.

Proper accounting ensures a strong financial foundation and prevents early-stage mismanagement.

At Tax Filing Time

Governments require accurate financial reporting to assess taxes.

Without structured financial accounting, companies risk overpaying taxes, underreporting income, or facing penalties for mistakes.

When Seeking Investment or Business Loans

Investors and banks demand clear, audited financial statements before providing funds.

A well-prepared balance sheet and income statement reassure them that the business is creditworthy and sustainable.

During Expansion or Scaling

Expanding into new markets, hiring more staff, or launching new products requires a clear view of cash flow and financial capacity.

Accounting reports guide whether the company can afford such growth without overstretching resources.

Before Audits, Mergers, or Acquisitions

Auditors, potential buyers, or merger partners rely on accurate accounts to verify financial health.

Incomplete or inaccurate records can delay deals, reduce valuations, or trigger compliance issues.

Businesses need financial accounting at every stage of their lifecycle from launch to growth to expansion. However, it becomes especially crucial when making major financial decisions, complying with regulations, or seeking outside funding. Without it, companies risk financial instability and missed opportunities.

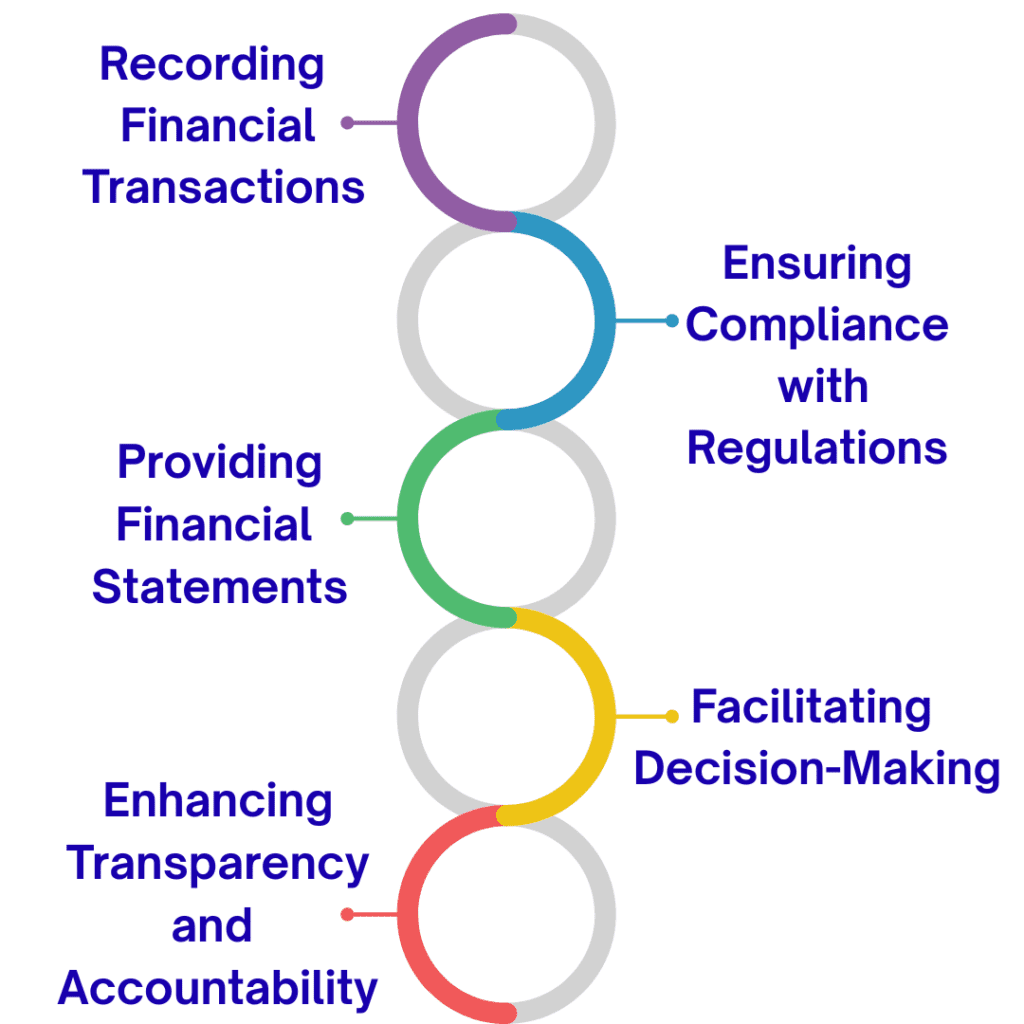

Financial accounting helps businesses record financial transactions in an organized way. Every company deals with income and expenses daily, and keeping an accurate and systematic record helps track where money is coming from and where it is going. This ensures financial consistency and reliability, reducing errors and making it easier to analyze trends. Proper recording also helps businesses manage cash flow and plan for the future. Without clear records, companies may face problems in making financial decisions or following rules.

Financial statements are important reports that show a company’s financial health. There are three key reports: the Balance Sheet, Income Statement, and Cash Flow Statement. The balance sheet lists a company’s assets and liabilities, the income statement shows earnings and expenses, and the cash flow statement tracks how money moves in and out of the business. These reports help business owners, investors, and stakeholders understand profits and losses, making it easier to plan for growth.

Financial accounting makes sure businesses follow tax laws, corporate regulations, and industry standards. By using GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards), companies prepare financial reports in the correct way. Following these rules improves business credibility and prevents fines or legal trouble. When businesses stay compliant, they gain investor trust and build a strong reputation.

Financial reports help business leaders make better choices. They use financial statements to decide on investments, expansion, and cost management. These reports provide real data about the company’s performance, helping leaders use resources wisely. Without proper financial accounting, businesses may struggle to make the right decisions. Whether hiring employees or launching a new product, financial data ensures decisions are based on facts.

Financial transparency is important for businesses. It helps stakeholders, investors, and regulatory bodies understand a company’s financial status. Clear financial records prevent fraud and ensure ethical financial practices, which builds trust. Companies that are open about their finances are more likely to attract investors and create strong business relationships. By ensuring accountability, financial accounting helps businesses stay honest and grow successfully.

Financial accounting is like a guidebook for businesses. It helps them track income, expenses, assets, and liabilities, so they know exactly how much money is coming in and going out. This helps companies make smart decisions about saving, spending, and investing. Without proper financial accounting, businesses might spend too much or not plan for the future, which can lead to losses.

One of the biggest benefits of financial accounting is that it builds investor confidence and business valuation. Investors, banks, and other stakeholders look at financial statements like the balance sheet, income statement, and cash flow statement to check if a company is doing well. When businesses keep their financial records clear and honest, they gain business credibility and attract more investors. This makes it easier for them to grow, take loans, and stay strong in the market.

Financial accounting also gives businesses a competitive advantage. By studying financial data, companies can see what’s working and what needs improvement. They can adjust pricing strategies, manage costs better, and plan for growth. Following tax laws, corporate regulations, and industry standards also keeps businesses safe from legal troubles. A company that uses financial information wisely can make better decisions and achieve long-term profitability.

Good financial accounting helps businesses keep track of their money, follow rules, and grow successfully. By following some simple steps, companies can keep their financial records clear, avoid mistakes, and make better decisions.

Financial accounting is the foundation of every successful business. It helps companies keep track of their money, follow tax laws and corporate regulations, and make smart financial decisions. By maintaining accurate financial records, using reliable financial statements like the balance sheet, income statement, and cash flow statement, and ensuring regulatory compliance, businesses can build investor confidence and improve their business credibility.

Good financial accounting also supports long-term profitability and sustainable growth by helping companies plan ahead, manage costs, and stay competitive. Whether it’s a small startup or a large corporation, following the best financial accounting practices ensures financial

Subscribe to our newsletter and stay updated.