- About us

- Outsourcing

- Strategic Finance

- Compliance & Tax

- Automation

- Group Companies

- Resources

- Career

Since its launch in 2017, the Goods and Services Tax (GST) has revolutionized India’s indirect tax system. It replaced multiple state and central taxes, bringing uniformity, simplicity, and transparency to how businesses handle taxation.

But with every financial year, GST rules, rates, and compliance requirements evolve — and 2025 has brought some of the most significant updates yet. Understanding these changes is vital for every business, whether you’re a small startup, a freelancer, or a large-scale manufacturer.

In this blog, we’ll explore what GST is, which types of GST apply to businesses, and what the latest GST updates mean for entrepreneurs, accountants, and decision-makers. We’ll also answer common FAQs to help you navigate this changing tax landscape confidently.

GST (Goods and Services Tax) is a comprehensive, destination-based tax applied to the supply of goods and services. Instead of dealing with multiple indirect taxes like VAT, excise, and service tax, businesses now handle a single tax system that simplifies accounting and compliance.

GST helps:

Businesses registered under GST registration must file regular GST returns, make GST payments online, and follow accurate invoice formats as per GST council guidelines.

Whether you run a restaurant, export goods, or work as a freelancer GST impacts how you bill, collect, and report taxes.

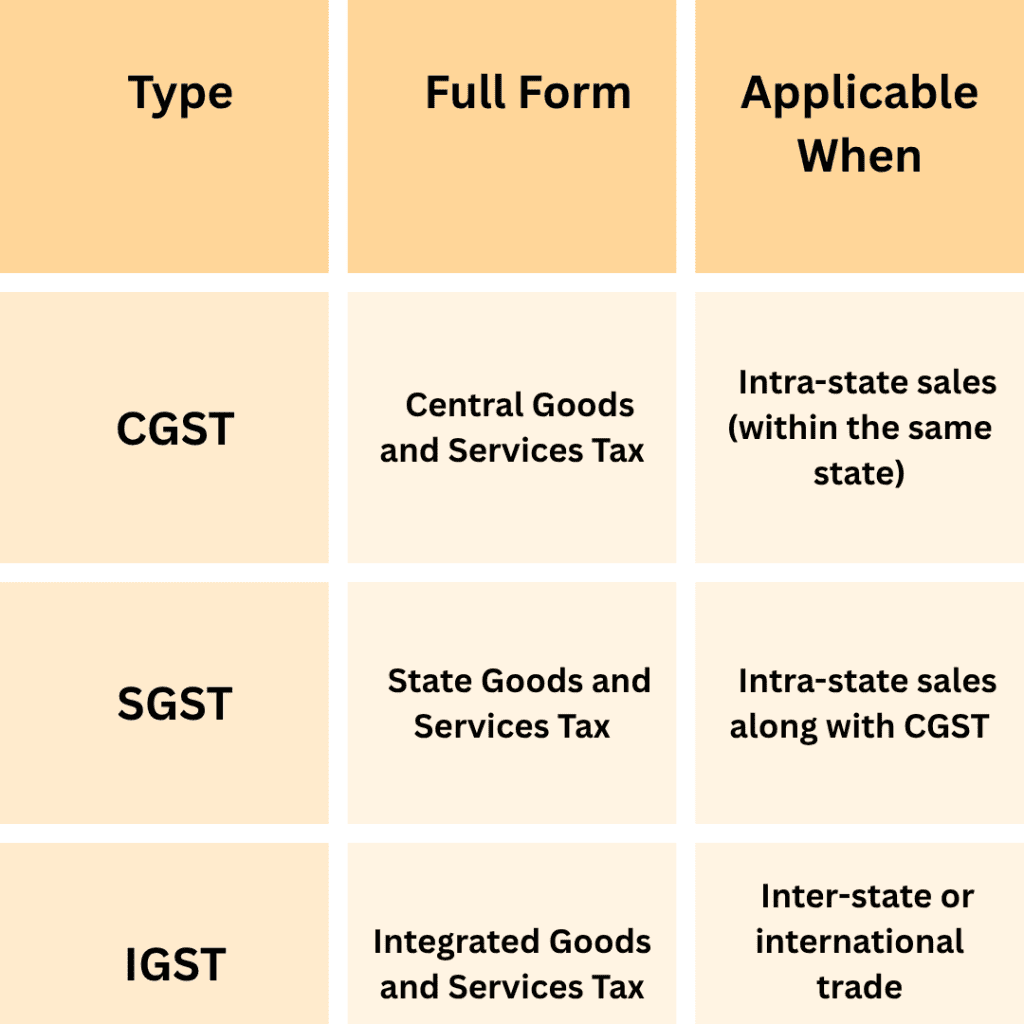

India’s GST system is divided into four components, depending on where the goods or services are sold:

For example, if a business in Maharashtra sells products to a buyer in Delhi, IGST applies. But if both parties are in Mumbai, CGST + SGST will be charged.

This structure ensures fair distribution of tax between the central and state governments while maintaining pricing consistency for consumers.

The GST Council introduced several key reforms in September 2025 under the GST 2.0 update framework, aiming to simplify rates and make compliance easier for small and mid-sized businesses.

Here are the highlights of the latest GST updates (2025):

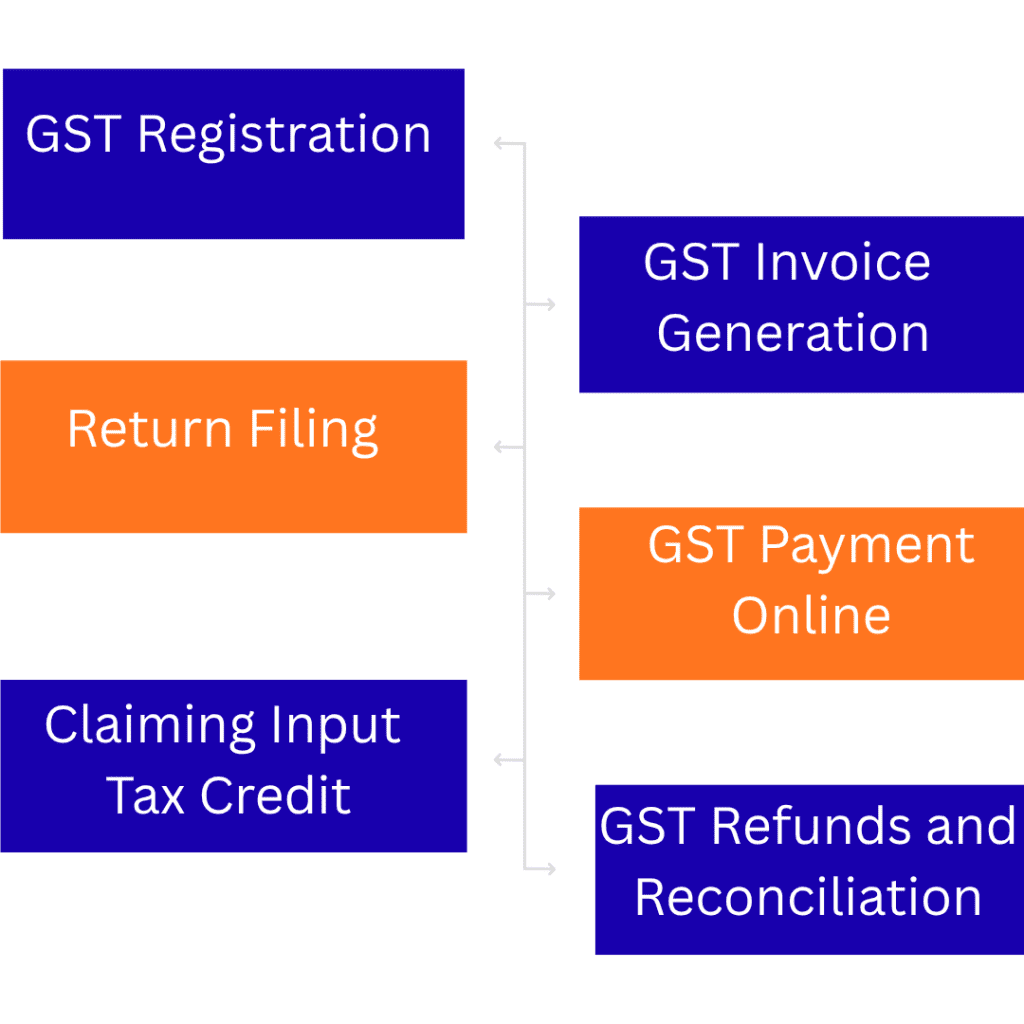

A complete GST compliance cycle includes:

Businesses that exceed the prescribed annual turnover threshold must register for GST through the official www.gst.gov.in portal. Registration ensures your business is legally recognized under the GST regime and allows you to collect taxes from customers. It also enables claiming Input Tax Credit (ITC) on purchases, improving your overall tax efficiency.

A GST-compliant invoice is mandatory for all taxable sales. Businesses can create invoices using approved GST invoice formats or Excel templates that include details like GSTIN, HSN codes, and tax rates. Proper invoice management ensures transparency, avoids mismatches in returns, and strengthens audit readiness.

Filing GST returns such as GSTR-3B (monthly) and GSTR-9 (annual) is crucial to maintain compliance. These returns capture details of outward and inward supplies, input tax credits, and tax liabilities. Regular filing helps businesses avoid penalties, maintain financial accuracy, and build a compliant reputation with tax authorities.

The GST system promotes digital compliance through online tax payments. Businesses can easily pay dues via the GST portal using internet banking, UPI, or debit/credit cards. Timely online payments ensure smooth reconciliation, prevent interest or late fees, and make tax management more convenient and transparent.

ITC allows businesses to offset the GST paid on purchases against their output tax liability. This mechanism helps reduce cascading taxes and improves cash flow efficiency. To claim ITC successfully, businesses must ensure accurate invoices, vendor compliance, and timely return filings to maintain seamless financial records.

Eligible businesses can apply for GST refunds for excess tax payments, export-related claims, or input tax accumulation. Regular reconciliation between books and GST returns is vital to detect discrepancies early. Accurate reconciliation not only ensures financial transparency but also speeds up refund processing and compliance audits.

Even though GST was introduced to simplify India’s tax structure, staying compliant with the system isn’t always easy. Frequent GST rate updates, new GSTR forms, changes in input tax credit (ITC) rules, and strict filing deadlines can create confusion for finance teams especially for businesses managing operations across states or countries.

Errors in GST return filing, mismatched invoices, or delayed payments can quickly lead to penalties or audits. That’s why many growing companies are turning to Finance and Accounting Outsourcing (FAO) partners to handle their GST-related compliance with precision and expertise.

Outsourcing firms employ professionals who are constantly updated on new GST notifications, circulars, and GST Council amendments. These experts ensure your returns, filings, and invoices comply with the latest rules such as the 2025 GST slab restructuring and automated ITC reconciliation.

Outsourcing partners also manage complex transactions involving reverse charge mechanisms, e-invoicing, and international trade compliance seamlessly.

Leading FAO providers integrate your accounting data with cloud-based GST filing software. This ensures all transactions are automatically validated against government data and mapped correctly to GSTR-3B, GSTR-9, and other forms.

Automation minimizes human error, ensures timely GST payment online, and prevents duplicate entries. Most systems now support invoice format in Excel with GST or online GST bill format making compliance faster and more transparent.

Businesses with multiple locations or subsidiaries often face challenges reconciling input and output GST across states. Outsourced teams centralize this process ensuring accurate consolidation under CGST, SGST, and IGST categories.

With expert reconciliation, even complex cases like GST for manufacturing industries or GST for real estate projects become manageable. Outsourcing ensures every branch meets compliance requirements without duplication or data gaps.

Outsourcing providers maintain digital records for every transaction, making audit preparation faster and more reliable. Their systems are designed to be audit-ready, ensuring compliance with both national and international standards such as IFRS and GAAP.

When the GST department requests supporting documents or conducts inspections, outsourced teams can instantly provide reconciled data, verified GST invoices, and supporting ledgers saving your internal finance team time and stress.

Instead of hiring in-house tax professionals or maintaining expensive software, outsourcing provides on-demand access to experts and tools at a fraction of the cost.

As your business grows, FAO partners scale operations seamlessly whether you add new product lines, expand to new states, or enter global markets.

Outsourcing also prevents financial risks associated with non-compliance, missed deadlines, or inaccurate filings giving you complete peace of mind.

A leading electronics manufacturer struggled to manage complex tax reconciliations after the September 2025 GST reforms changed slab rates. Their internal finance team was overwhelmed with updates to invoices, returns, and credit notes.

By partnering with an outsourced accounting provider, the company:

Within a quarter, the firm achieved smoother cash flow, faster return submissions, and complete compliance with revised GST laws.

In an ever-evolving regulatory landscape, businesses that outsource their GST compliance and filing gain three key advantages:

Professional outsourcing teams bring precision and punctuality to every stage of GST compliance. They ensure that all returns, invoices, and payments are completed correctly and submitted before deadlines—eliminating the risk of penalties or interest. Every transaction is cross-verified with purchase and sales records to maintain data integrity and avoid discrepancies during audits.

Modern GST outsourcing solutions leverage advanced automation tools and cloud-based accounting platforms to simplify compliance workflows. These technologies eliminate manual data entry errors by auto-syncing invoices, tax amounts, and transaction details directly from accounting systems.

Outsourcing GST compliance offers significant cost advantages by reducing the need for an in-house team dedicated to tax filing and reporting. Instead of managing multiple accountants or investing in expensive compliance software, businesses gain access to professional expertise at a fraction of the cost.

From GST registration and invoice management to return filing and refund processing, outsourcing provides complete peace of mind for CFOs and business owners.

You can complete your GST registration through the official GST portal by submitting your business details, PAN, Aadhaar, and bank account information. Once verified, you’ll receive a GST Identification Number (GSTIN) used for all tax transactions.

To make your GST payment online, log in to the GST portal, generate a challan, and pay via internet banking, debit/credit card, or NEFT/RTGS. Timely payment ensures smooth GST return filing and avoids penalties.

To claim Input Tax Credit, you must ensure that your vendor’s GST invoice is valid and uploaded in the portal. The credit amount is then adjusted against your output tax liability.

Always use the prescribed GST invoice format or invoice format in Excel with GST that includes GSTIN, HSN codes, and applicable tax rates. Many businesses now use digital tools to generate online GST bill formats automatically.

Under the Reverse Charge Mechanism, the buyer (and not the seller) pays GST directly to the government for certain transactions. It applies to imports, unregistered suppliers, or specific notified services.

Businesses with an annual turnover exceeding ₹40 lakhs (₹20 lakhs for service providers) must register for GST. However, voluntary registration helps even smaller businesses claim input tax credits and boost credibility.

GST compliance plays a vital role in maintaining transparency and efficiency within India’s tax system. With its structured framework for registration, invoicing, return filing, and tax payments, GST has unified the indirect tax process across the country. Businesses that stay updated with the latest GST rules and filing timelines not only avoid penalties but also build a strong foundation for financial credibility and growth.

As digital platforms continue to simplify processes and government systems evolve, ensuring timely and accurate GST compliance has become essential for every modern business. By staying informed and adopting efficient practices, companies can focus more on growth while maintaining full alignment with India’s regulatory standards.

Subscribe to our newsletter and stay updated.