In a world where agility and efficiency determine success, Finance and Accounting Outsourcing (FAO) has become a cornerstone strategy for forward-thinking businesses. From startups to large enterprises, organizations are increasingly turning to outsourcing not only to cut costs but to gain access to specialized expertise, advanced technology, and global financial best practices. At its core, FAO enables companies to delegate non-core financial operations – such as bookkeeping, payroll, tax filing, and compliance to skilled professionals who bring precision, scalability, and innovation to the process. This strategic collaboration allows businesses to redirect internal focus toward growth, strategy, and customer experience rather than getting entangled in repetitive financial workflows.

In today’s digitally-driven business ecosystem, where automation, analytics, and AI redefine traditional finance, outsourcing is no longer just a back-office decision it’s a transformation lever. The right FAO partner helps organizations enhance profitability, compliance, and operational transparency, ensuring that financial data becomes not just accurate, but actionable.

Finance and Accounting Outsourcing (FAO) is the process of entrusting a company’s financial management and accounting operations to a specialized external service provider. This includes a wide spectrum of activities – from basic bookkeeping and payroll processing to complex financial reporting, budgeting, and strategic analysis.

In simple terms, outsourcing allows businesses to leverage the expertise, technology, and global best practices of professional accounting firms without maintaining large in-house finance departments. This approach not only ensures accuracy and compliance but also enables companies to operate with greater agility and cost efficiency.

For instance, many organizations already outsource functions like marketing, IT infrastructure, and customer support to focus on their core business. In the same way, finance outsourcing might include services such as accounts payable and receivable management, tax preparation, audit support, or payroll administration – all handled by domain experts using cutting-edge digital tools.

Organizations seek the services of FAO for different reasons, but a few stand out as universal benefits:

In the modern business environment, where accuracy, speed, and compliance determine long-term success, Finance and Accounting Outsourcing (FAO) has become a strategic enabler of profitability and regulatory excellence. Rather than simply reducing costs, FAO helps organizations unlock hidden efficiencies, strengthen governance, and drive sustainable growth.

Outsourcing finance and accounting functions enables businesses to streamline operations, control overheads, and optimize resource utilization. By partnering with experienced outsourcing providers, organizations gain access to a team of financial professionals and advanced technologies — without the expense of maintaining an in-house department.

Reduced Operational Costs: Instead of investing heavily in hiring, training, and maintaining an internal finance team, outsourcing offers access to experts at a fraction of the cost. This frees up capital that can be reinvested in product development, marketing, or expansion.

Process Automation and Efficiency: Leading FAO firms use tools like AI, RPA (Robotic Process Automation), and cloud-based accounting platforms to speed up transaction processing and eliminate manual errors. This improves turnaround time and ensures real-time financial visibility.

Better Resource Allocation: When repetitive and time-consuming tasks such as bookkeeping, payroll, or invoice management are outsourced, internal teams can focus on strategic decision-making driving innovation and customer value.

Scalability Without Added Costs: As your business grows, outsourcing partners can easily scale their services to meet increasing transaction volumes, seasonal spikes, or new compliance requirements without the need for new infrastructure or staffing.

Together, these factors lead to improved profit margins, leaner operations, and better financial forecasting, ensuring that every rupee or dollar invested contributes directly to business growth.

In today’s globalized economy, maintaining compliance with ever-evolving financial and tax regulations is both critical and complex. Non-compliance can lead to penalties, reputational damage, and operational setbacks. A reliable FAO partner helps businesses stay compliant across jurisdictions while maintaining transparency and accountability.

Expert Regulatory Knowledge: Outsourcing firms employ professionals who are well-versed in local and international accounting standards such as IFRS, GAAP, and SOX, ensuring accuracy and adherence to the latest guidelines.

Automated Compliance Systems: Advanced accounting software automates compliance workflows — from tax filings and statutory reporting to audit preparation minimizing human error and ensuring deadlines are met.

Robust Data Security: Reputed FAO providers follow strict ISO-certified security frameworks, use data encryption, and implement access control protocols to safeguard sensitive financial information.

Cross-Border Compliance Expertise: For businesses operating globally, outsourcing partners bring deep knowledge of international tax laws and regulatory frameworks, helping ensure that financial operations align with multiple country-specific requirements.

Audit Readiness: Regular monitoring, reconciliation, and documentation help maintain audit-ready books, reducing stress during financial inspections or regulatory reviews.

By combining automation, expert oversight, and robust governance systems, outsourcing ensures that businesses remain compliant, transparent, and risk-resilient even in complex regulatory environments.

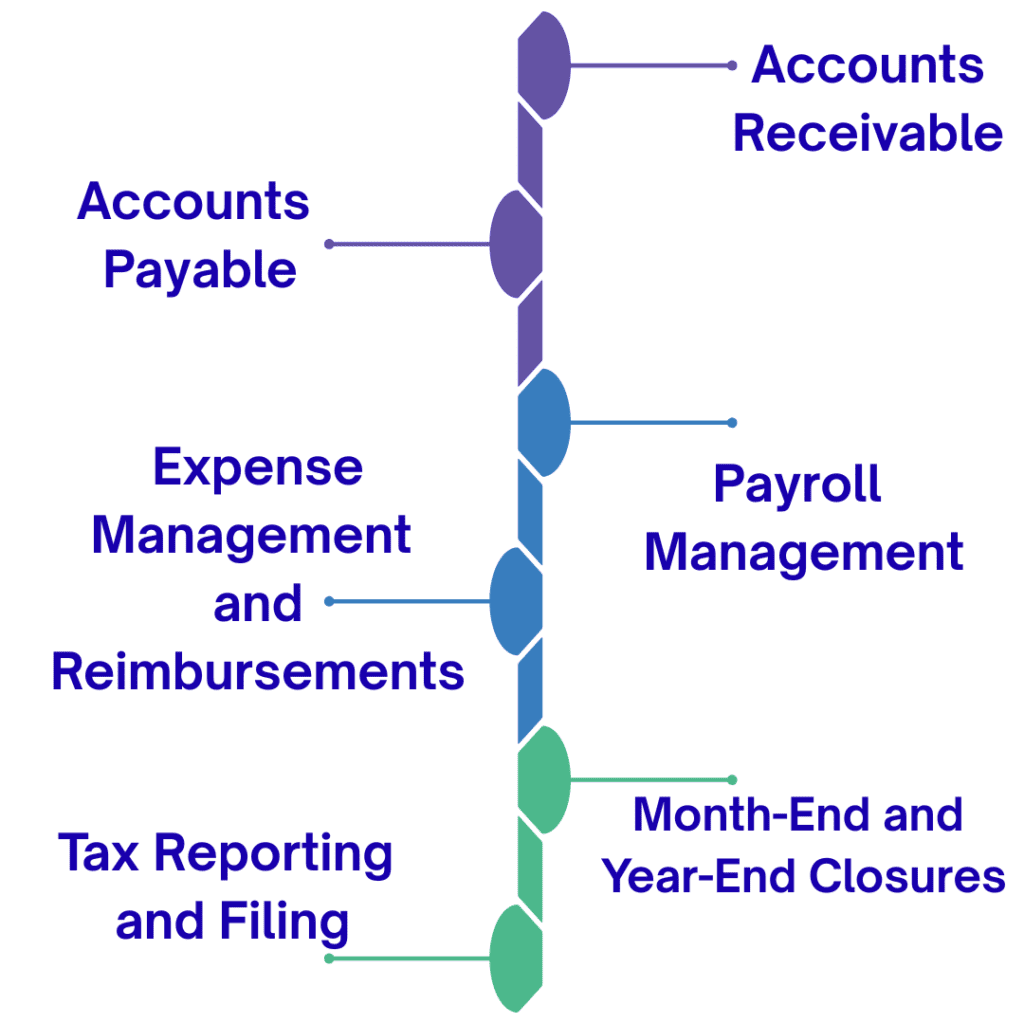

Not all finance and accounting tasks need to be handled in-house. Outsourcing allows businesses to delegate both routine, transactional tasks and high-value, judgment-intensive processes to specialized experts. By strategically choosing which functions to outsource, organizations can achieve greater efficiency, accuracy, and compliance while freeing internal teams to focus on core business objectives.

Accounts Payable (AP): Managing vendor invoices, verifying transactions, and ensuring timely payments. Outsourcing helps maintain consistent payment cycles and accurate record-keeping while preventing duplicate or late payments.

Accounts Receivable (AR): Tracking customer payments, sending reminders, and reconciling outstanding balances. FAO providers ensure healthy cash flow and minimize delays in collections.

Payroll Management: Handling salary disbursements, statutory deductions, and compliance with local tax and labor laws. Outsourcing guarantees accurate, timely payroll processing without administrative burden.

Expense Management and Reimbursements: Streamlining employee expense reporting and approvals, ensuring transparency and adherence to company policies.

Tax Reporting and Filing: Preparing and filing accurate tax returns on time, ensuring compliance with ever-changing tax regulations.

Month-End and Year-End Closures: Reconciling accounts, preparing financial statements, and ensuring books are accurate and audit-ready.

By outsourcing these transactional activities, companies can achieve greater consistency, cost savings, and operational efficiency, while freeing up internal teams for more strategic financial analysis.

In today’s fast-paced business environment, staying compliant with ever-evolving financial regulations is critical. Non-compliance can lead to hefty fines, reputational damage, and operational disruption. Finance and Accounting Outsourcing (FAO) has emerged as a strategic solution, helping businesses not only manage their accounting efficiently but also strengthen compliance across the board. Here’s how outsourcing can make a difference:

One of the key advantages of outsourcing is access to highly skilled professionals who possess deep expertise in both local and international accounting standards. Whether it’s IFRS, GAAP, or SOX, outsourcing firms ensure that your financial operations adhere to the latest regulatory guidelines. These experts constantly monitor updates in accounting standards and compliance requirements, so your business remains accurate, transparent, and fully compliant, minimizing the risk of errors or penalties.

Modern FAO providers leverage advanced accounting software to automate compliance-related workflows. From tax filings and statutory reporting to audit preparation, these systems significantly reduce manual intervention, thereby minimizing human error. Automation also ensures that critical deadlines are consistently met, giving businesses peace of mind and freeing internal teams to focus on strategic initiatives rather than paperwork.

Compliance isn’t only about regulations; it’s also about safeguarding sensitive financial data. Reputable outsourcing partners implement ISO-certified security frameworks, use robust data encryption, and maintain strict access control protocols to protect your information from unauthorized access or cyber threats. By outsourcing, companies benefit from enterprise-level security measures that may be costly or complex to implement internally.

For businesses operating across multiple countries, navigating different tax laws and regulatory frameworks can be daunting. Outsourcing partners bring in-depth knowledge of international financial regulations, helping businesses stay compliant across borders. This expertise is invaluable for companies involved in global trade, investments, or multi-country operations, ensuring financial reporting and tax compliance align with each jurisdiction’s requirements.

Maintaining audit-ready financial records is crucial for smooth inspections and regulatory reviews. FAO providers conduct regular monitoring, reconciliations, and thorough documentation, ensuring that books are always prepared for internal or external audits. This proactive approach reduces stress during financial inspections, supports transparency, and enhances the credibility of your organization’s financial statements.

Finance and Accounting Outsourcing (FAO) covers a wide spectrum of essential business functions. By entrusting these tasks to specialized providers, companies can ensure accuracy, efficiency, and compliance while freeing internal teams to focus on strategic initiatives. Let’s explore the key areas where outsourcing adds value:

Managing vendor invoices, verifying transaction details, and ensuring timely payments are critical to maintaining good supplier relationships and operational flow. Outsourcing accounts payable helps businesses maintain consistent payment cycles, reduce errors, and prevent duplicate or late payments. FAO providers use automated tools and standardized processes to track invoices, approve payments, and generate accurate records, ensuring smooth financial operations without administrative bottlenecks.

Tracking incoming payments, sending reminders, and reconciling outstanding balances can be time-consuming but is vital for maintaining healthy cash flow. Outsourcing accounts receivable ensures that customer payments are monitored efficiently, overdue invoices are addressed promptly, and financial records are accurately maintained. FAO providers implement structured collection processes, reducing delays and helping businesses stay financially agile.

Handling payroll internally involves managing salary disbursements, statutory deductions, and compliance with local tax and labor regulations a process that can be complex and error-prone. Outsourcing payroll management guarantees accurate and timely salary processing, adherence to statutory requirements, and elimination of administrative burdens. Employees receive their salaries on time, while businesses stay compliant with evolving tax and labor laws.

Employee expense reporting and reimbursement processes often involve multiple approvals and verification steps. FAO providers streamline expense management, ensuring transparency, adherence to company policies, and timely reimbursements. Automated systems track expenses, prevent fraudulent claims, and provide detailed reports for better financial oversight.

Tax compliance is critical, with frequent changes in regulations posing challenges for internal teams. Outsourcing tax reporting and filing ensures that accurate returns are prepared and submitted on time, minimizing the risk of penalties. Experienced providers stay up-to-date with tax laws, optimize deductions where applicable, and handle all statutory filings efficiently.

Reconciling accounts, preparing financial statements, and closing books at the end of each month or year are crucial for accurate reporting and audit readiness. FAO providers ensure that month-end and year-end closures are thorough, precise, and timely, reducing errors and supporting management with actionable insights. This proactive approach makes audits smoother and enhances financial transparency.

Look for a partner with years of expertise in finance and accounting. Check client references, case studies, and industry-specific experience.

Ensure clear onboarding, knowledge transfer, and implementation timelines. Confirm transparency in deliverables, communication, and reporting.

Cloud-based solutions for real-time collaboration. Ability to integrate with your existing systems (technology agnostic). Advanced tools like AI, RPA, and automated reporting dashboards.

Verify ISO certifications and compliance with data privacy regulations. Look for strong encryption, access controls, and confidentiality protocols.

Regular KPI tracking for cost savings, turnaround time, and error reduction. Ensure accountability and continuous improvement.

Partner with a team whose work culture aligns with your organization. Open, proactive communication to facilitate collaboration.

Ability to provide solutions tailored to your business needs. Scalable services that can grow with your organization.

In today’s dynamic and digitally driven business world, Finance and Accounting Outsourcing (FAO) has evolved from being a cost-cutting tactic to a strategic business enabler. It empowers organizations to operate with greater agility, transparency, and accuracy – while freeing leadership to focus on core objectives and innovation.

By leveraging the expertise, technology, and scalability of specialized outsourcing partners, businesses can transform their financial operations into a strategic growth engine. From improved compliance and reporting accuracy to enhanced decision-making and risk management, FAO delivers measurable value across every layer of the organization.

Subscribe to our newsletter and stay updated.