Growing businesses naturally prioritize revenue, expansion, hiring, and product development. Payroll is often viewed as a routine back office task until workforce growth and compliance complexity turn it into a high risk function. Errors in employee salary processing, payroll tax calculation, or statutory payroll compliance can quickly affect employee trust and expose the business to penalties.

Today, payroll outsourcing for growing businesses is more than a cost decision. It is a strategic move to improve payroll accuracy and reporting, strengthen payroll compliance management, and enable flexible payroll management during expansion. As headcount increases and payroll management challenges multiply, many companies reassess whether in-house systems can deliver the control, efficiency, and payroll risk reduction required for sustainable growth.

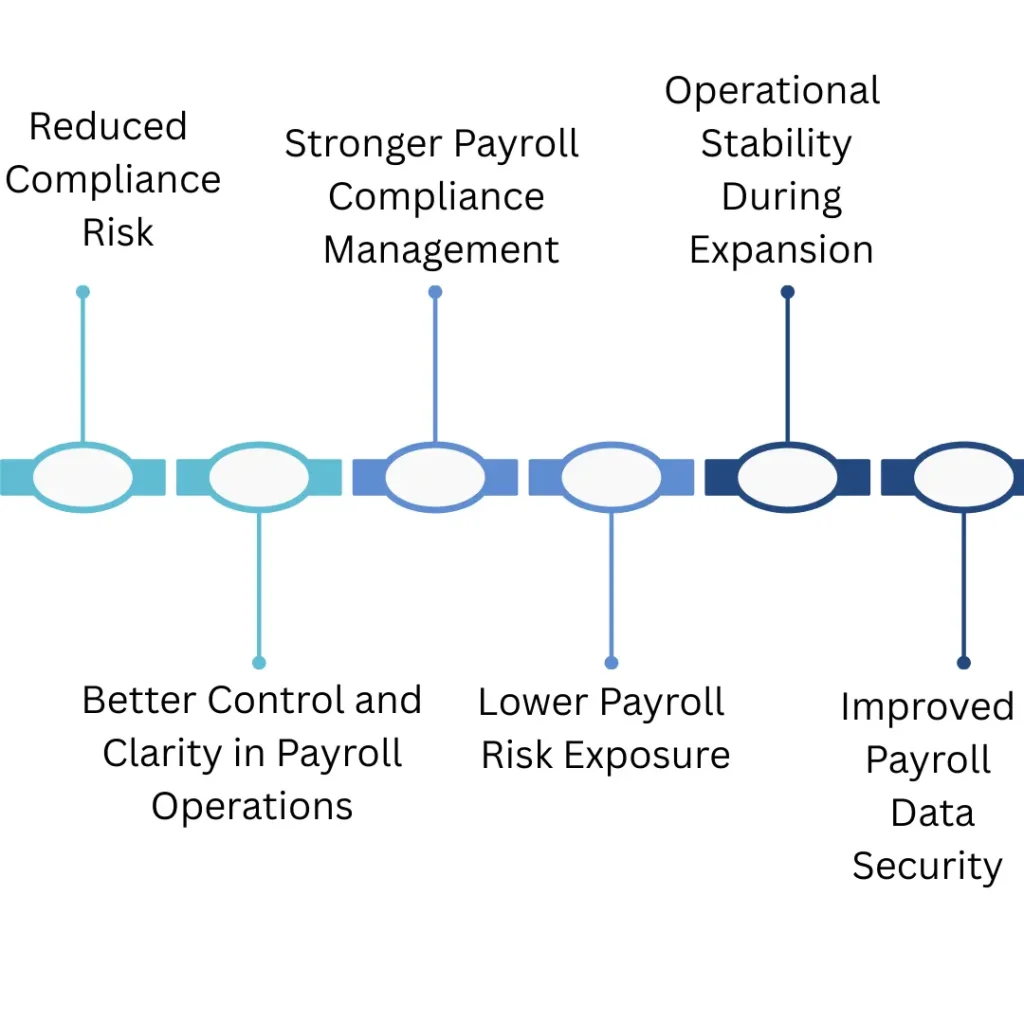

At its core, payroll outsourcing means transferring payroll administration responsibilities such as tax filing, compliance reporting, and salary processing to specialists. The goal is optimization through reduced payroll processing errors, stronger payroll data security, better payroll cost control, and access to scalable payroll solutions that support expanding businesses.

Why businesses outsource payroll often comes down to complexity and focus. As companies grow, leadership teams prefer to focus on revenue, operations, and market expansion rather than payroll administration. High payroll administration cost combined with compliance pressure pushes many companies to evaluate alternatives.

Payroll outsourcing for startups and payroll outsourcing for small businesses often begins when internal teams can no longer manage statutory payroll compliance efficiently. Workforce expansion introduces new allowances, deductions, and tax obligations. Without proper systems, payroll processing errors and payroll reporting issues increase.

Payroll support during expansion also ensures flexible payroll management. Instead of hiring additional administrative staff, organizations use scalable payroll solutions that adjust with headcount. This makes payroll outsourcing for fast-growing companies a practical approach to maintaining consistency without overbuilding internal infrastructure.

The operational advantages of payroll outsourcing become visible when comparing daily workflow efficiency. These benefits typically include:

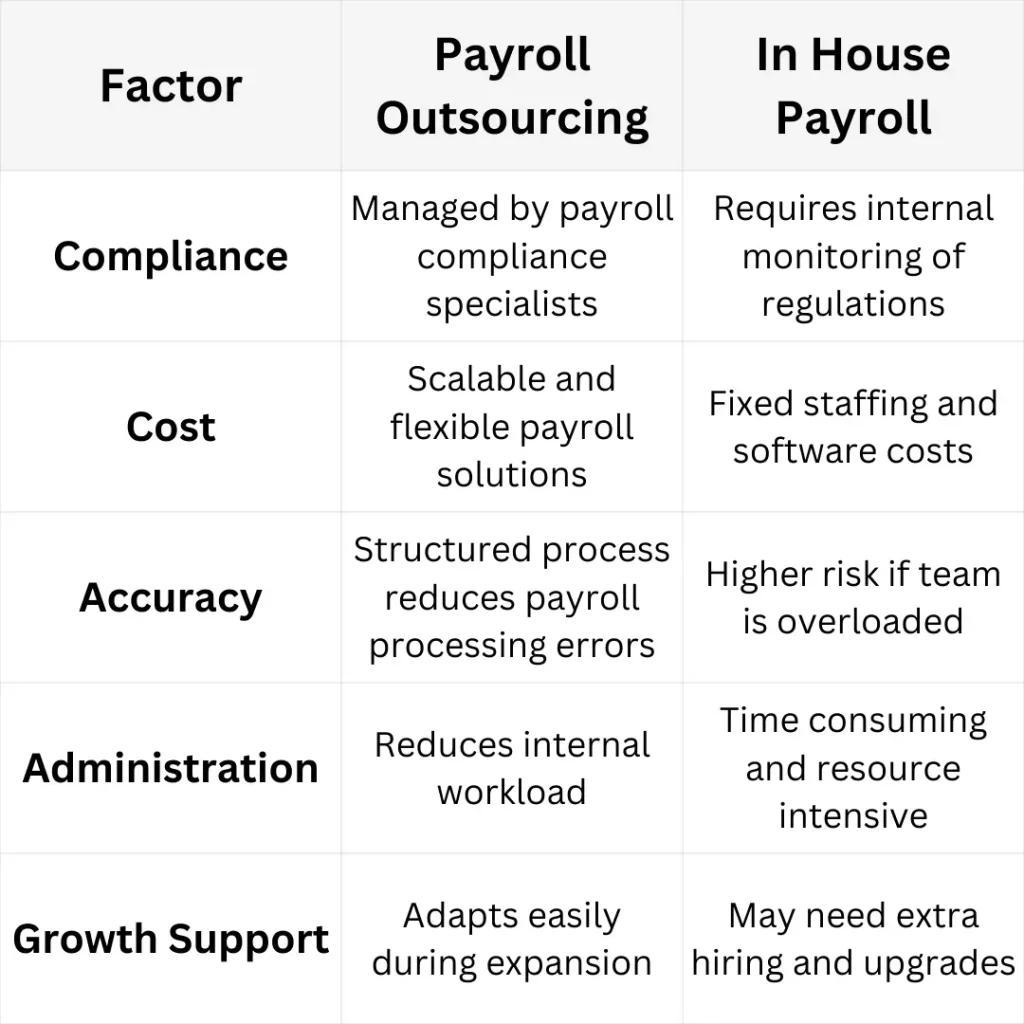

These cost benefits of payroll outsourcing are especially relevant for businesses evaluating payroll outsourcing vs in-house payroll. Internal teams often struggle with fragmented systems, outdated software, or limited expertise in payroll compliance management.

Is payroll outsourcing worth it depends on how a business evaluates time, risk, and growth priorities. For small teams with limited complexity, in-house payroll may function adequately. However, as hiring accelerates and compliance demands increase, payroll management challenges multiply.

Payroll outsourcing advantages for growing companies include structured oversight, reduced payroll processing errors, and clearer reporting. How payroll outsourcing improves efficiency becomes evident when administrative tasks are streamlined and supported by payroll automation tools. This not only strengthens payroll accuracy and reporting but also reduces dependency on manual spreadsheets and fragmented tracking.

From a compliance perspective, how payroll outsourcing reduces compliance risk is critical. Growing organizations face increasing scrutiny around labor laws and tax regulations. A well-managed outsourced model ensures payroll compliance management is treated as an ongoing responsibility rather than a reactive task.

Rapid hiring increases payroll complexity. Payroll outsourcing for growing businesses goes beyond salary processing and provides structured support during expansion, new branch setups, and workforce growth.

Each new employee adds statutory payroll compliance responsibilities, tax reporting, and documentation requirements. Scalable payroll solutions allow companies to manage growth without constantly redesigning internal processes. This stability is especially important for payroll outsourcing for fast growing companies.

As teams expand, payroll processing errors become more common in manual systems. Payroll automation improves payroll accuracy and reporting while reducing payroll reporting issues and strengthening payroll data security. Structured systems also support payroll risk reduction.

Payroll outsourcing for startups and payroll outsourcing for small businesses helps leadership focus on growth instead of administrative tasks. Flexible payroll management ensures employee salary processing and payroll tax calculation remain consistent without building large internal teams.

Improved HR and payroll integration further reduces duplication and calculation mistakes, supporting payroll cost control and better financial planning. For expanding businesses entering new regions, outsourcing ensures consistent compliance and reduces exposure to penalties.

As organizations grow, payroll management challenges increase in complexity. What starts as a simple salary process evolves into ongoing compliance, reporting, and tax responsibilities.

Payroll outsourcing for growing businesses offers structured processes, scalable payroll solutions, improved payroll compliance management, and payroll risk reduction. When comparing payroll outsourcing vs in house payroll, the key consideration is long term operational stability.

For expanding companies, outsourcing provides discipline and efficiency while allowing leadership to stay focused on strategy and growth.

Is payroll outsourcing worth it for growing companies?

Yes. It improves payroll accuracy and reporting, reduces compliance risk, and lowers administrative burden during workforce growth.

How payroll outsourcing reduces compliance risk?

It ensures consistent payroll tax calculation, timely filings, and adherence to statutory payroll compliance requirements.

What are the main advantages of payroll outsourcing?

The main advantages of payroll outsourcing include payroll cost control, payroll risk reduction, improved data security, fewer payroll processing errors, and flexible payroll management.

When should a business consider payroll outsourcing?

Businesses often consider payroll outsourcing for startups, small businesses, and expanding companies when internal payroll management challenges begin affecting compliance and efficiency.

Subscribe to our newsletter and stay updated.